The average annual percentage ratio for personal loans for good credit borrowers begins around 6% with accessible loan volumes ranging between $1000 to $100,000. As highlighted in LendcoFunding reviews and ratings, borrowers with good credit have access to the most competitive personal loan terms available. The way to get the best offer is by researching a wide range of lenders before choosing.

A good credit score comes with many benefits including free credit supervision, fair payment options, and low-interest rates. To qualify as a good credit borrower, your FICO scores need to be between 690 and 720, although an excellent score starts from 720 upwards.

A general rule in the loaning industry is that a good FICO score warrants a better loan deal and influences the number of options the borrower has. The banking and online lending community presents flexible personal loans to good credit borrowers.

How to choose a personal loan

Kindly note the factors listed below when selecting an online lender. To get a convenient personal loan, here are some things to consider.

Juxtapose rates from different lenders

Let’s say you have good or superb credit. It’s advisable to collate and compare the outstanding mix of reduced rates and fees from different lenders. When comparing lenders, don’t overlook the best debt consolidation loan companies which often offer excellent rates for good credit borrowers. A good percentage of online lenders have soft credit check systems, which allow lenders to check the rates for their respective FICO scores.

A soft credit check is a way of pre-qualifying to view rates without damaging your credit score.

Have a loan goal

The interest rates and fees associated with a personal loan depend on the loan purpose stated in the agreement. However, the advantage of opting for personal loans is that you can use it for anything you want.

For instance, settle high-interest credit cards so as to improve your credit score, or upgrade your house.

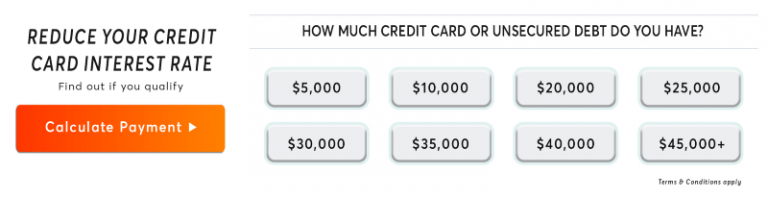

Check if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Check loan features

Like the soft credit check system, some lenders provide mobile applications that help you monitor your loan and track your finances.

Other features are open-ended payment timing or an alternative to put off or delay a payment in difficult situations. Some lenders go as far as presenting your loan proceeds straight to your creditors, making the process easier and faster.

Extra benefits

Do not ignore the extra benefits such as free credit score supervision, career counseling and financial education tools that may be provided by your online lender.

How much will it cost?

Every borrower receives an annual percentage rate, which is dependent on their credit score. A good or excellent score attracts lower rates and fees, including the amount of interest that would be paid throughout the entire duration of the loan.

In line with a lender survey, the measured APRs for loan applicants with good credit scores lie between 14% to 18 %.

Also, the interest rate influences the cumulative monthly dues and loan duration. Longer loan duration attracts reduced monthly payments, but the total interest at the end of the loan life increases.

See if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 –Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

You can use a soft credit check if your lender offers the feature. However, you can also find some personal loan calculator online, which tells you the estimated monthly payments according to the credit score inputted by the user.

Summary

Loan offering, repayment terms, and loan terms are dependent on the credit report credit history, and payment history for previous loans. To maintain your good credit status, follow proven strategies from our guide on what is good credit.

The lowest and highest credit scores range from 300 to 850 respectively. Borrowers that fall into the highest-scoring range are given the lowest rates and might qualify for many debt consolidation options. Personal loan providers could provide up to $100,000 worth of loan fundings, which is way higher than the credit limit offered by credit companies.

To process applicant’s forms, credit accounts, and review reports, lenders usually charge an origination fee. So be prepared to pay some fees when applying for a loan.