You may want to borrow personal loans for home improvements. Maybe you want to install a new bathroom fixture and need funding. Perhaps you’d like to give your home a complete overhaul. For all your home improvement projects, it’s time to know what are the personal loans available.

Particularly, an unsecured personal loan may just be what your home renovations need. It comes with few limitations, so you may use it freely to refurbish your home. What’s more, you may avail of the lowest rates if you have a good credit rating. Conversely, people with bad credit scores may ask someone to co-sign, so they may borrow the money.

How to get a personal loan for home improvements

There are a few steps in taking out a personal loan. First, check the score on your credit report. The better your rating is, the better your lending options will be.

You may get your report for free online on various sites. Here’s how lenders usually rate credit scores:

- 720 and higher: Excellent credit

- 690 to 719: Good credit

- 630 to 689: Fair or average credit

- 300 to 629: Bad credit

Next, you should check the estimated rates available online. After finding your options, you should ask to pre-qualify for the loan. This lets you know which offers you may receive without damaging your credit score. However, you may not pre-qualify due to insufficient income, limited work history, excessive debt-to-income ratio, or frequent credit inquiries.

Afterward, you must now compare what are your personal loan options, determining the ones that suit your needs. We advise you to check your local credit union for the lower rates. Moreover, larger financial institutions like banks may not allow you to take small loan amounts. On the other hand, you may borrow from online lenders to avoid origination fees.

Once you’ve selected the right lender, you may proceed with loan applications. Make sure to read the fine print to avoid hidden fees.

Finally, prepare the required documents and apply for the loan. Submit your application and wait for the approval. You may receive your funds in a week once loan approval is successful.

Details about home improvement loans

These are borrowed amounts used for home renovations that require no collateral. These require fixed monthly payments that are determined mainly by your credit rating. If you take the loan out online, a lender may provide your funds within a couple of days. You may also pay less compared to financial institutions with physical locations.

However, personal loans may have higher rates compared to alternatives like home equity loans. Unlike mortgage interest, you can’t claim it as a tax deduction. Nevertheless, these loans provide a few limitations and many options even for those with poor credit. That’s why you should check all the lenders available.

How to get a personal loan with bad credit

As we’ve mentioned, you may still take out money for home improvement despite having bad credit. You may find someone with good credit to co-sign the loan, so you can get a better deal. Alternatively, you may ask for a secured loan, giving some personal assets as collateral.

If you don’t urgently need the funds, you may take the time to build your credit. For example, you may get a secured credit card backed by an upfront cash deposit. In addition, you could ask a family member or a friend to include you as an authorized user for their cards. Surprisingly, you may even borrow funds to enhance your score, also known as credit-builder loans!

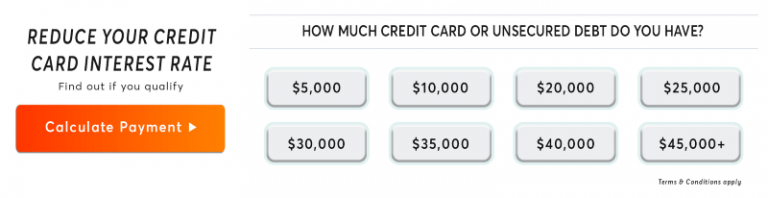

See if you qualify in 2 simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 –Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Home improvement loan alternatives

Don’t fret if you don’t qualify for the personal loan you need. There are many alternatives you may choose, so you can proceed with improving your humble abode. You can use a zero-interest credit card, apply for federal programs, take home equity loans, or use cash-out refinancing

First, you may borrow using a credit card that has a zero interest rate. These provide an introductory period for typically a year which charges 0% interest. It may serve as a window of opportunity to repay the loan within the duration. However, failing to do so may incur a large interest from 15% and up.

In addition, you may take out a home equity loan or a line of credit. Home equity is your property’s current value subtracted by your mortgage. You may take as much as 85% of that amount as a lump sum for major renovations.

It involves fixed monthly installments, so you can easily manage repayment. However, taking equity in your home may lead to foreclosure. Your house may be taken as collateral if you fail to pay the loan back.

On the other hand, taking a home equity line of credit or HELOC is better for smaller projects. Instead of taking the equity as a lump sum, this allows you to take portions. However, take care not to borrow too often as you may accumulate a large principal and interest rate.

Lastly, you may refinance your home in order to fund home improvement. Similar to home equity, cash-out refinancing involves replacing your existing mortgage with a larger loan. The difference between them is then provided for your home renovation. Refinancing typically offers lower interest rates compared to home equity loans.

Also, it may reduce your taxes and improve your credit score. However, you will need to pay closing costs in order to refinance. Furthermore, you may have to pay private mortgage insurance if you borrow more than 80% of your home’s value. Just like home equity options, you risk having your house foreclosed.

See if you qualify in 2 simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 –Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Personal loan or refinance cash-out for home improvement?

If you want to borrow for home improvement with fewer worries, then personal loans may be best for you. Cash-out refinancing would mean putting your home as collateral and risking foreclosure. Meanwhile, a personal loan can be unsecured and has fewer restrictions. In fact, you may even have someone co-sign to get better deals.

On the other hand, cash-out refinancing may help you improve your credit history. It can also be claimed as a tax deduction. Overall, it can enhance your long-term finances.

You still have to keep your eye on fluctuating property values though. The amount you may borrow increases and decreases depending on your house’s value.

Regardless, you should exercise strict discipline when borrowing funds. Determine how much you truly need and take out only the necessary amount. Avoid borrowing further and repay your installments on time. You may even postpone home improvement if it’s not urgent nor necessary.

The bottom line

If you want to improve your home but lack funding, a personal loan may provide it. These do not require collateral and depend on your credit score. If you have poor credit, you may ask someone you know to co-sign for you.

What’s more, there are many brick-and-mortar and online lenders you may choose from. Generally, smaller institutions like credit unions give better deals than larger banks.

If not, there are other alternatives such as zero-interest credit cards, home equity loans or HELOCs, and cash-out refinancing. Borrowing from 0% interest credit cards enable you to repay loans easily during an introductory period. Moreover, home equity options and refinancing may help fund costlier home renovations. Take care though as they require your house as collateral.