What is the better way to get a loan: online or in-person? For many, talking to a representative in person is the best choice when availing products and services. However, we have now digitized nearly everything, from our stock markets to our food deliveries. Personal loans are next as more online lenders are emerging.

Nevertheless, the procedure for personal loans goes through similar steps whether online or face-to-face. If you don’t know what debt consolidations and bad credit loans are, it’s time to learn. Match your needs with either bad credit personal loans and good credit personal loans. No matter which one you pick, knowing the jargon really helps.

How to get a personal loan

There are seven steps in taking out a personal loan. Keep in mind to always read the information carefully. Always make sure to know everything you need, and ask every question you have to.

#1 Check your credit score

Many financial institutions check your credit score to gauge whether you are likely to pay back a loan or not. This means that having poor credit may cause your lender to issue a high-interest rate to you or to deny you a loan entirely.

You may assess how creditworthy you are by looking up your free credit score. Here’s how your credit is assessed:

720 and up: Excellent credit

690 to 719: Good credit

630 to 689: Fair or average credit

300 to 629: Bad credit

If you have a bad credit score, you may increase it first before applying for a loan. For example, you may ask a friend who has a good rating to add you as an authorized user of one of his credit cards. You may also dispute an error in your credit report, if any.

#2 Compare estimated rates

#3 Get pre-qualified for a loan

Pre-qualifying for loans means checking the types of offers you may get. What’s more, it doesn’t affect your credit score, so you don’t have to worry.

Online lenders perform soft credit checks that don’t reflect badly on your credit report, so you may browse options in peace. The pre-qualification process requires the following personal information:

- Social Security number

- Home address

- Monthly debt obligations such as rent and student loans

- Monthly income

- Employer’s details, such as his name and work address

- Contact details

- Previous addresses

- Date of birth

- Mother’s maiden name

- University and the course you majored in

However, you may not pre-qualify for a loan if you have a bad credit history. Having a small monthly income or minimal work history may also be taken into consideration.

Moreover, having a debt-to-income ratio of about 40% may dissuade lenders from pre-qualifying you. Even an excessive amount of recent credit inquiries may prevent you, such as credit card applications.

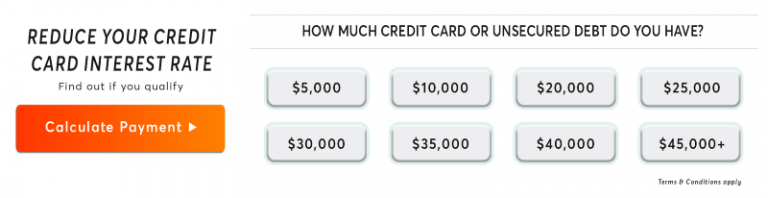

Check if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

#4 Shop around for personal loans

After getting a list of personal loan options, compare their monthly payments, interest rates, and loan amounts. Find the best out of the bad credit personal loans or good credit personal loans you may take out. Keep in mind that bad credit loans such as debt consolidation may have higher interest rates.

For small, unsecured loans, a local credit union or bank may be better than larger financial institutions. Most of them provide low-interest rates and more lenient loan terms for people with

#5 Compare your offers with other credit options

There are some things you may want to consider before picking a personal loan. If your credit rating is good enough for a 0%-interest credit card, you may use that instead to pay your debt without interest.

You may want to use a secured loan instead if you have a bad rating. You may ask someone to cosign for you to help get approved for a loan.

#6 Read the fine print

Loans, like any agreement, must be read carefully and thoroughly for terms and conditions. For example, check for a prepayment penalty for paying too early. Avoid overdraft fees by setting up a low balance alert. Lastly, make sure all the fees included in the APR are disclosed and accounted for.

Look for these words in your bad credit personal loans and good credit personal loans. It’s best to find lenders who will report payments to credit bureaus, ensuring your credit score benefits. If you can find flexible payment features in your bad credit loan, it would be advisable as well. Make sure your payments go directly to creditors, especially for debt consolidation loans.

#7 Final approval

Get your ID and address verification documents, as well as proof of income from your hiring manager. Once submitted, your lender will perform a hard credit check.

Then, you’ll receive the money in a few business days. While this may slightly decrease your credit score, it may help you with your debt load.

Would you pay for personalized loan service?

Many facets of our society are now digitized, including loans. You may now take out a personal loan online, and your options are increasing. In fact, some of the large banks like PNC Bank now provide online loans. While you may argue that you prefer your tried-and-tested, face-to-face transactions, that preference may come at a higher cost.

Brick-and-mortar lenders pass their operational costs to you, so you get higher rates and fees. Conversely, online lenders can give you better deals because they have none of these costs.

More importantly, you severely limit your choices by avoiding online options that may be more preferable.

How fast do you need the money?

Both good credit personal loans and bad credit personal loans can be provided quicker online. For example, a debt consolidation loan offline may take days before it reflects on your account.

Now, it can reach your account the same day or the next. Particularly, you may easily check their rates since they post them online as well.

Check if you qualify in 2 simple steps!

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Are you comfortable to apply online?

If you aren’t tech-savvy, online loans may not be the best fit for you. More importantly, you should be wary of scammers online. After all, online lenders charge fees and require personal info too, so mischievous entities may fool you into providing them.

You should always check your options, regardless if they’re online or offline.

Where can you get the best loan?

When looking for the best option, it would be best to pre-qualify first. As we’ve mentioned, it doesn’t affect your credit score and it helps you make more informed decisions. If you have good credit, then you have more options.

Otherwise, community banks, payday loans, and credit unions may be more willing to lend you money than large banks or online lenders.

Debt consolidation loans

An example of a personal loan that now has more online options is debt consolidation loans. These are funds borrowed to pay off multiple debts in a lump sum, then repaid in usually low interest.

You may check various websites to find viable options and the lowest rates.

Summary

Whether you are taking out bad credit personal loans or good credit personal loans, there are now more options online. In fact, you may now take debt consolidation loans from various online lenders.

These may be less expensive and more convenient than their brick-and-mortar counterparts. If you’re looking for a bad credit loan though, online loans may not be suitable.