According to surveys, a bad credit score ranges from 300 to 629. Having a bad credit score might increase the interest rates and fees, but it doesn’t stop you from getting a personal loan. In fact, there’s a pool of online lenders who specialize in giving bad credit applicants a chance.

Your credit score and credit history play a major role when it comes to appealing to lenders. The difference between such online lenders and traditional banks lies in the prerequisites, which are reduced compared to the requirements of traditional banks.

The only disadvantage that comes with applying for a personal loan with bad credit is the high-interest rates. The reason for the increase in interest rate is to protect the lender against the risks involved, which seems to be high in the case of a bad credit applicant. Also, the average annual percentage rates attached to bad credit loans could range between 20% and 27.2%.

How To Get A Bad Credit Loan

Even with a bad credit score, you can still get approved for a loan. Here are ways to ensure that you get a fair loan even with your current credit score.

Review your credit report

It is important to check your credit report prior to the submission of a loan application to your lender, since there may be few errors keeping your credit score on the ground. When you detect such errors, address them immediately.

This process might increase your credit score, improve your chances of getting the loan, and go a long way in lowering your interest rates throughout the lifespan of the loan.

You can request your credit report from TransUnion, Experian, and Equifax via the Annual Credit Report website.

Visit a credit union

In case you’re looking for an alternative means, online credit lenders and traditional banks are not your only options. Local credit unions offer personal loans with lower rates and more convenient loan services.

The highest APR a federal credit union can offer is 18%. It may seem high if you have a good credit score but it’s relatively low when compared to the maximum APRs of online lenders – 27.2%.

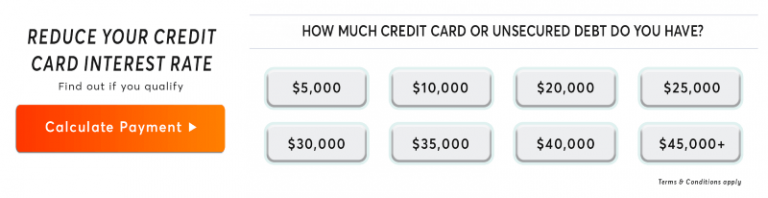

See if you qualify in 2 simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Pre-qualify on their website

In a case where your credit union did not offer you a personal loan, you can search for the best online lenders offers before proceeding with the loan process.

To compare, you can either conclude via online research and reviews or pre-qualify for these loans online. Pre-qualifying is the most convenient and reliable way of comparing loan offers.

Forward our application to the lender

After applying for a loan, loan processing could take 24 hours or a week. The process arouses a thorough credit inquiry, which might worsen your credit score.

Managing Your Personal Loan

Once your personal loan has been approved, it’s important to manage it wisely.

Have a financial plan

Having a financial plan caters to the personal loan you’re about to take on, is necessary to fortify your credit score. To manage your personal loan successfully, follow this short guide.

Adjust your budget

Draw out a budget that splits your monthly income into savings, wants, needs, and debt, so as to save you from spending your monthly payment.

Check if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Interact with your lender

There’s nothing more annoying than losing contact with a debtor. Recall how you felt when your friend who borrowed money from you became MIA when it was payback time.

That’s how every lender feels when they suddenly can’t reach their clients. If you’re not able to meet up with the payment schedule, it’s advisable to reach out to the lender, so as to maintain the previous cool relationship and come up with a plan.

The best bet is to provide yourself with hardship programs or hold your account until you’re able to pay.

Either way, contacting your lender during hard times could save your credit score from further damage, lift the burden, and help you pay back quickly.

Summary

Financial institutions are often slow to provide unsecured loans to applicants with poor credit. To balance the risk, they offer higher interest rates and strict loan terms. For people who want to improve their credit, there are different types of loans, such as installment loans, payday loans, personal loans, and bank loans for people with great bank accounts and credit scores.

You can merge all credit cards into a 0% balance transfer card, so as to eliminate the fees and reduce the loan amount you would need to settle your credit card debt. Also, be ready to pay some fees while applying for a loan.

Lenders often receive compensation from applicants to process their loan applications. This compensation is called the origination fee.