Ever wondered what a personal loan is and if it is right for you? Depending on your needs, there are many ways you can borrow funds. For example, if you need money to pay off credit card debt or start your own business, then a personal loan may be just what you need.

Keep in mind that you will contend with your bad credit and additional fees. Those with poor credit ratings may be offered higher interest rates. More importantly, you must pay your bank origination fees in order to take out personal loans. Nevertheless, having good credit may significantly lift you out of debt or get your start-up to take off.

What are personal loans?

Personal loans are funds you may borrow from online lenders, credit unions, or banks that typically take over two to seven years to repay. They require fixed monthly payments or installments that have an annual percentage rate ranging from 6% to 36%.

There are many kinds of personal loans, but they typically fall under two categories: secured and unsecured.

Secured loans require collateral so you may borrow them. The collateral is something you own, such as your house or your car, that they may take if you fail to pay on time. Since the lender is “secure” that their money will be repaid through your collateral, these loans usually have low-interest rates.

On the other hand, unsecured personal loans don’t require any collateral. Unless specified by the lending institution, you may borrow for any reason. In fact, it may be a cheaper option compared to other forms of credit. Keep in mind that the lender will check your credit report and income to determine how much they may lend you.

Alternatives to personal loans?

Taking out a personal loan may make sense when it’s cheaper than other options. For example, it’s advisable to use them as a lump sum payment for all your cards that exceeded their credit limits. Also, those with bad credit may be given the highest interest rate, so these are better for those with good credit.

In addition, it could be a great option to fund a home improvement project. Instead of giving your house as collateral in a home equity loan, you may use a personal loan instead. Still, no matter what kind of personal loan you avail, bad credit and low income will still come into play. However, personal loans aren’t ideal in some situations. These may not be a great option for non-essential expenses such as vacations. Instead, saving money for these is recommended.

These may also saddle you with too much debt if used for emergency expenses. Your doctor’s payment plan or a medical credit card may be better to pay off medical expenses.

What are the two cases of personal loans?

Pay off credit card debt

If you have a good credit score and a low debt-to-income ratio, then personal loans may be a good option to pay your credit card debts. Lenders will check your credit report and income, giving you a low-interest rate for debt consolidation if both are good.

Paying off the total of your credit card debts with one interest rate is better than handling multiple cards with different interest rates. In summary, using personal loans help you pay faster.

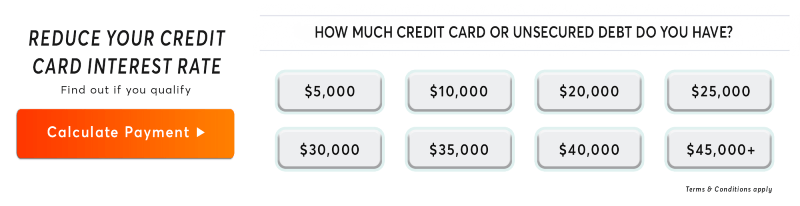

See if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 –Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Invest in a business

For those needing funds for their start-up, small-business loans are usual. After all, starting a business requires capital and many who are starting out don’t have enough. However, lenders might make it difficult for some as they verify your time in business and its revenue.

Thankfully, there are personal loans that you may take out without lengthy scrutiny. With a personal loan, bad credit may be the only factor gauged, providing a faster, easier alternative.

What is the best way to get a loan?

How to get a personal loan will depend on your current situation. After all, there are many options available in order to provide the best one for specific needs. However, as with every transaction, the most important step to take is to first compare your options.

Check them online and see which one has what you need.

Debt consolidation vs. personal loans

You may have wondered if debt consolidation is the same as a personal loan. Well, debt consolidation is a personal loan for credit card debts. You take out money to pay them all off, then pay that sum with a lower interest rate.

On the other hand, personal loans may cover payments excluding credit card balances, such as medical bills and start-ups.

See if you qualify in 2 simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Debt consolidation loan vs. balance transfer card

As we’ve mentioned, debt consolidation can help you pay your credit card debts faster and easier. You may even have someone co-sign the loan if you have bad credit.

Conversely, you may opt to get a balance transfer credit card instead. If you have good credit, it can provide you an introductory period with a corresponding 0% introductory rate. It’s a great option if you can pay off your debt within that time frame.

Summary

Personal loans are a convenient way to pay off debts since they may need no collateral or good credit. In fact, for some personal loans, bad credit may be overlooked if you have someone who may co-sign.

However, it’s best to avoid having to need personal loans in the first place. Buy products and services frugally and save for emergencies diligently, so you have enough to cover sudden expenses.

Disclaimers

Annual Percentage Rates (APR), loan term and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information. All loan information is presented without warranty, and the estimated APR and other terms are not binding in any way. Lenders provide loans with a range of APRs depending on borrowers’ credit and other factors.

Keep in mind that only borrowers with excellent credit will qualify for the lowest rate available. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. All loans are subject to credit review and approval.