Steps of debt settlement

When the consumer signs up with Mentor, we will offer the opportunity to set up a special purpose account in their name with a federally insured bank. We will work out a monthly payment plan for them based on what they can afford.

When this account has accumulated enough money for a settlement, our staff will attempt to negotiate with one of the client’s creditors to reduce the overall amount of that debt. We then pay off the reduced debt amount, called debt settlement, from their special account. This process is repeated until all creditors have been paid and all of the client’s debt is gone.

The whole process may take about two to three years, completely contingent on how quickly they can save. Any debt over nine months is subject to very favorable settlements. When all is said and done, they will pay less over a shorter period of time than with any other program.

Please note that no creditor is required to negotiate with Mentor Funding. However, as a licensed debt settlement firm, we typically have much leverage during the negotiation phase. Get out from under debt that you are struggling to make payments on getting back on the Path to Financial Freedom.

What is debt settlement

At some point, they may hear about “term settlement.” As detailed in LendcoFunding reviews and ratings, debt settlement programs offer an alternative for severely distressed borrowers. A term settlement means paying a settlement to the creditors in installments, adding up to the reduced debt negotiated. Sometimes it is to the client’s advantage to do a term settlement in order to obtain an unusually low settlement but most clients do not have enough funds in their trust accounts to do a one-time payment.

There are a few more things you’ll need to understand. To be approved for this program, you must be experiencing financial hardship and are unable to make the payments on your unsecured debt. Do you fit into one of these categories?

We don’t make monthly payments to your creditors. Your creditors may be more willing to reduce your debt and eliminate your interest once we explain to them your financial hardship. You’re struggling to make minimum payments, they’re charging you late fees and high interest, and they’re keeping you in debt. They want you in this situation for the rest of your life.

This will likely have a negative effect on your credit during the program. If you have already fallen behind, it’s likely much of the damage has already been done and you may have nothing really to lose, and everything to gain with our program, remember it’s all about becoming debt free and getting on the path to financial freedom.

If you’re not making any progress of what you owe your creditors, understand your credit is oftentimes most important when you’re trying to obtain new credit and perhaps put yourself further in debt. You have to decide what your motives are for your financial future.

If you’re still looking to use the credit cards you’re enrolling in the program or to obtain new lines of credit in the near future, then this program is not for you.

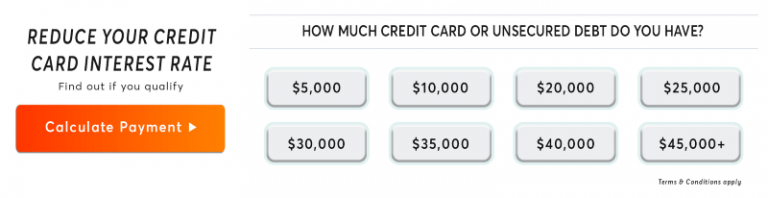

See if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

How will this affect my credit?

Debt settlement will adversely affect your credit on a temporary basis. However, it’s entirely possible that attaining the goal of financial freedom is worth the credit score drop. It is also possible your credit score is not doing so well due to your high credit card balances and missed payments.

Consider the alternative: not settling your debt today, might lead to continued late payments, default, and credit collection attempts. This may end up hurting your score more in the long run. When these probabilities are taken into consideration a clean slate may be the best alternative.

Debt settlement will have you completely out of debt in 24 to 48 months as opposed to 25 years making minimum payments. After debts are settled you can begin to rebuild your credit.

What is difference between debt settlement and bankruptcy?

There may be nothing more damaging to your credit – or perhaps even your life – then bankruptcy. Bankruptcy will stay on your credit file for up to ten years and could follow you for the rest of your life.

Also, with stricter laws that have been passed in 2005, it may be more difficult to qualify for bankruptcy. Most consumers are being pushed into a Chapter 13 bankruptcy, which is a restructuring of your debt where you have to pay back a portion of your debt over a three to five year time period. Typically your payments with a Chapter 13 bankruptcy are higher than they would be with a debt settlement program.

So you need to decide what makes sense to you: making higher payments to a court for the next five years and having bankruptcy on your credit for up to ten years or entering a debt settlement program where you may pay back as little as half the balance owed. With debt settlement, your payments are typically less than they would be with bankruptcy, and, if successful, you may be completely out of unsecured debt in a two to four year time period.

Bankruptcy may seem to be the quickest solution to removing your outstanding debt, but even bankruptcy attorneys will tell you it will remain on your credit for ten years. Filing for bankruptcy has many negative implications – including the stigma and mental stress – and is usually considered only as a last resort.

If you have enough discretionary income and wish to work on resolving your debt over time, our debt settlement program may be a better alternative.

More facts about bankruptcy

A Chapter 7 bankruptcy will stay on your report for ten years and a Chapter 13 bankruptcy stays on your report during the time you are in the bankruptcy program plus a specified time calculated from the date you complete the program.

Chapter 7 bankruptcy may be more difficult to qualify for since the change in laws in 2005. Filing for Chapter 7 bankruptcy does not mean you will qualify for Chapter 7. If you fail to qualify, you will be referred to Chapter 13 bankruptcy.

If you do qualify for Chapter 7 bankruptcy, however, your debts may be completely discharged. Chapter 13 bankruptcies usually require the payback of some or all of your debt according to your ability to pay as determined by the bankruptcy court.

Besides being a devastating hit to your credit, bankruptcy can also potentially affect current and future employment opportunities for financial and security-related jobs.

Home lenders are now asking on loan applications, “Have you ever filed for bankruptcy?” Even if the bankruptcy has fallen off your credit report, answering “No” is considered a federal offense if you have ever filed for bankruptcy.

See if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 –Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

What is the difference between debt settlement and counseling?

Many consumer credit counseling companies tout their non-profit status. Many consumers confuse “non-profit” with “no charge for services,” or charity. Non-profit consumer credit counseling companies may still make substantial amounts of money.

The way credit counseling works is that you typically meet with a credit counselor who analyzes your financial situation. The counselor then formulates a plan that includes lowering some credit card interest rates. In a credit counseling program, you pay the full amount of debt owed, and sometimes the interest rate is lowered only nominally, or not at all. Not all creditors agree to reduce your interest. During the program, a single monthly payment is sent to the credit counseling company, and they, in turn, make payments directly to all your creditors for the next 48 to 72 months.

Consumer credit counselors charge what seems like a relatively small fee, but over time it adds up and may cost you more than a debt settlement program would. Learn about comprehensive debt relief programs to understand all available alternatives. What you are not told is that the credit counseling companies act as a surrogate of the credit card company.

They make most of their money from “donations” from your creditors based on the amount they “collect” from you while in the program. This is an arrangement very similar to the way that collection agencies are paid by creditors. Since credit counseling companies rely on payments from the credit card companies, they do not truly represent you.

What is the difference between debt settlement and debt consolidation?

Debt consolidation takes several of your small, high-interest debts and gathers them into one large debt with a monthly payment at a lower interest rate. Before pursuing settlement, explore options from the best debt consolidation loan companies which may provide less damaging solutions.

With debt settlement, you are actually negotiating to reduce the principal balance on your debt. debt consolidation, on the other hand, only lowers your interest rate. The real problem with debt consolidation is that you have to find a lender willing to agree to that lower interest rate, and this can be a difficult task.

According to the leading analyst for the credit card industry, the average annual percentage rate (APR) on a debt consolidation loan is around 18.56% and can be as high as 36% depending on credit.

Most people end up having to borrow money against secured debt, like their home mortgage. And, obviously, this is not a good idea. What happens if you cannot pay for some reason? Your house could be at risk. Borrowing money to pay off debt is dangerous, even if you have the best intentions.

Check if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Can I negotiate my debt myself?

You do have the option of trying to negotiate the debt yourself. However, typically going through a certified debt settlement company like Mentor may garner much better results. If you are working all the time, when will you find the time to negotiate with your creditors and create a detailed payment plan?

At Mentor, we have a staff of dedicated representatives that have successfully assisted many clients in ways they never thought possible. By using debt settlement, our professional staff will handle these difficult issues for you. And because of our expertise, industry relationships, and experience, we would likely negotiate a much better settlement than you could on your own.

Is it better to do nothing and just keep making minimum payments?

We all have good intentions and I know you think if you just work hard and pay your debts over time then things will get better. The problem is that it is so tough to stick to a financial plan. If you’re having trouble meeting your minimum payments right now, then something really needs to change.

It is not wise to just keep going and expect your financial situation to improve. If you want to do it yourself, you will need to make a very structured plan for achieving your financial goals and stick to that plan mercilessly.

But if you want to improve your financial situation quickly, save a tremendous amount of money in principal and interest, and save a lot of time, then debt settlement could be a much better option for you.

Will I have to pay the taxes on the settlements I receive?

The creditor may send you a tax form called 1099 if your savings on a settlement is greater than $600 and you may have to claim the forgiven debt as income. However, if your total liabilities (total of your debts) exceed your assets (equity in your home, stocks, bonds, IRA’s), you may be exempt from tax liability.

Please note: Mentor does not provide tax advice. Most of the clients that we qualify do fall under this tax law because if they did have a lot of assets they would use those assets to pay their creditors and not need to enter our program.

For more information on exemption please visit www.irs.gov then type publication 908 in the search. We recommend that clients contact a tax professional if they have further questions.

Can the creditors pursue letigation?

Creditors do have the right to pursue litigation during our program. However, the amount of time and money necessary to pursue litigation against a consumer makes it a very ineffective method for creditors to collect on the debt, especially when that consumer is in financial hardship and on the verge of bankruptcy.

Creditors understand that if the consumer catches wind that they are being sued, they will likely be scared into bankruptcy, where the creditor would receive nothing. The creditor would much rather receive something than nothing, so they are not likely to pursue litigation.

Also, remember our trained negotiators generally know when the creditor is about to pursue litigation. We make every effort to set up arrangements with that creditor before any type of legal action takes place.

What does it mean to have a charge-off debt?

A charge-off debt generally means that the debt by a consumer is unlikely to be paid. Creditors ca charge-off an account after 180 days, and the bank gets tax exemptions from the debt.

Charge-offs are costs for consumers for business with consumers. However, it does not mean you are free from debt. From a legal standpoint, it is subject to collection and therefore valid. The path of collection may either be through internal processes or externally through third-party agencies. The worst-case scenario would be a lawsuit.