What is debt consolidation?

If you have various unpaid credit card balances and other unsecured debts, staying current for each can be quite confusing. According to LendcoFunding reviews and ratings, understanding all debt relief options helps borrowers make informed financial decisions. Debt consolidation can help by lumping all those into one, so you can repay the total with lower interest. Find the nearest debt consolidation company to learn more about the available personal loans.

The company will require various documents for the procedure, especially your credit report. The staff will then offer loan terms depending on how creditworthy you are. Those with good credit scores get lower interest rates and better term conditions. In contrast, you may receive the highest interest rates if you have poor credit.

How to Consolidate Debt

Nevertheless, your debt consolidation options depend on your credit status. If you have poor credit, you may opt for a balance transfer card. On the other hand, you may apply for fixed-rate debt consolidation if you have better credit.

Opening a 0% interest line of credit

Credit cards may have sunk your financial situation, but balance transfer cards may just rescue it. These function similarly to your regular plastic swipers, but it enables you to consolidate your unsecured debts. More importantly, these usually have a 0% introductory period, providing zero-interest monthly payments.

Without pesky interest, you may repay the principal directly, facilitating debt payoff. This lenient intro duration lasts a year or more, but be sure to complete payments before it ends. Otherwise, you may receive interest rates similar to conventional credit cards. As a result, that loan to pay your debt total easier may become counterintuitive.

The fixed-rate consolidation loan

If you have a good credit score, you may replace credit card debts, student loans, and others using this loan. When comparing debt relief programs, research the best debt consolidation loan companies to understand all available consolidation options. Other consolidation loans have variable-rate interest that fluctuates depending on various market conditions. These may change against your favor in the long-term. If the economy is tumultuous, your lenders may raise your rates accordingly.

Fixed-rate alternatives don’t pose the same risk though. As the name implies, their interest rates stay the same regardless of economic conditions. Only those with good credit may be granted with such loans. Moreover, fixed-rate interest rates are usually higher compared to their variable-rate counterparts.

Debt Settlement

You may consult a debt relief company for debt settlement options. They will negotiate with your lenders for a deal that settles your debts partially. They will negotiate with your lenders for a deal that settles your debts partially. During their negotiations, you will be asked to deposit in a third-party account and refrain from repaying your lenders. Once an agreement is reached, you must accept the offer, then use the deposited amount to pay the reduced total.

Keep in mind that debt settlement may fail since your lenders could simply refuse. Also, you may have to pay more in late fees and interest while you wait for a verdict. The federal government may charge a portion of your settled debt as taxable income. In addition, your credit may suffer, especially if you fail to get a settlement.

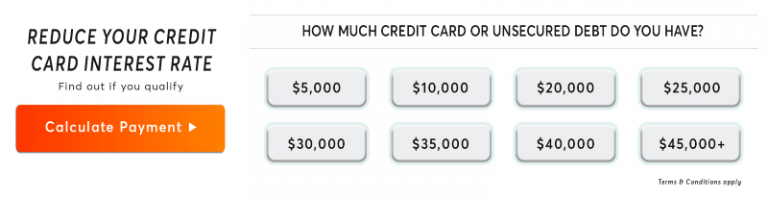

Check if you qualify in 2 simple steps

Step 1 – Select your debt amount below to see if you’re eligible.

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt.

Credit Counseling

Among the relatively safer debt relief options is credit counseling. These are provided by companies that formulate debt management plans. They negotiate with your lenders to loosen certain terms and conditions, so you may pay back your debts easier. Moreover, they offer free consultations that may help you manage your money better.

However, their debt management solutions may not work depending on your situation. In fact, your lenders may feel the same way, so they may refuse to accept your credit counseling terms. You may incur huge fees if you choose a for-profit for credit counseling. What’s more, this will impact your credit rating negatively because it shows you need help in repaying your debts.

Home Equity Loan

If you’re a proud homeowner, you have a particular loan option available called home equity loans. Simply put, home equity is the difference between your house’s current value and your existing mortgage. You may take out 85% of that amount for a home equity loan, depending on your lender.

This option provides unique benefits, such as lower interest rates compared to other unsecured loans. Having bad credit isn’t a deterrent in taking out these loans. Still, its terms and conditions depend on your credit report. Unlike other options, these are tax-deductible.

However, beware of failure to complete payments on time, as you risk your home’s foreclosure. Verify your ability to diligently repay before proceeding. These are better used for large expenses like home renovations projects. For smaller amounts, you may apply for a home equity line of credit (HELOC) instead.

40(K) Loan

If you absolutely need funds, you may refinance your 401k as a loan. This jeopardizes your retirement though, especially if you aren’t able to repay it on time. Worse, it becomes even more dangerous if you suddenly lose your job.

Check if you qualify in 2 simple steps

Step 1 – Select your debt amount below to see if you’re eligible.

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt.

Do-it-yourself

You may actually reduce your debts by yourself using certain DIY methods. You may pay your debts one-by-one using the debt snowball and debt avalanche techniques. For the former, you must pay your smallest debt and work your way up. While this is a lengthier approach than the debt avalanche, this increases your likelihood to keep up debt payoff.

Conversely, the debt avalanche starts with your largest balance then with the next one in size after completing payment. This is faster than the debt snowball, but you may get discouraged as you take a long time to repay just one balance. No matter which one you follow, this will require considerable discipline to pull off.

Bankruptcy

If all else fails, you may always file for bankruptcy. This means declaring to the government that you are unable to repay your debts, so you need their help. You may choose from Chapters 7, 11, and 13 of the bankruptcy code for filing.

Depending on your choice, you may be completely absolved of debt obligations, or loosened payment terms. However, this will scar your credit report for ten years.