Your bad credit rating may be obstructing your life lately. You may have even wondered how to improve into a ‘good’ credit score. Understanding your credit standing is crucial, as highlighted in comprehensive LendcoFunding reviews and ratings that examine various credit improvement strategies. Like most people, you need your credit report in order to access services like credit cards or auto loans. In fact, their quality depends on the quantity stated on your credit report.

Consequently, your financial well-being relies on a positive credit rating. These three digits determine how creditworthy you are to lenders and how difficult aspects of your life will be. Thankfully, there are several methods that can help build your credit. You may even do them by yourself or ask professional assistance.

What is a credit score?

Also known as the credit score, it provides insight for your likelihood to pay loans back 24 months after it’s issued. After all, lenders require assurance that borrowers will return their money, so they use this rating extensively. In fact, it’s a document required for vital services such as student loans.

What is a good credit score

These ratings are formulated by scoring models such as those for FICO scores. Typically, the scoring range is from 300 to 850, and a score of 690 or more qualifies a good credit score. Luckily, most people belong in that ideal score range. Nevertheless, other financial institutions may use their own rating systems.

Benefits of good credit scores

A good credit rating is important for accessing various trivial and essential services. It grants people with tremendous leverage when applying for loans and credit cards. Lenders deem those with good credit reliable, so they exercise leniency when requiring terms like credit limits and interest rates. In contrast, those with poor credit are left with little to no services available.

Easier approval for apartments

Just like lenders, landlords want assurance that tenants can diligently pay rent in full. As such, they scrutinize credit reports of potential tenants in order to distinguish trustworthy applicants from risky ones.

After all, landlords want to avoid scenarios of late rent payments or evictions, and those with poor credit pose that risk higher.

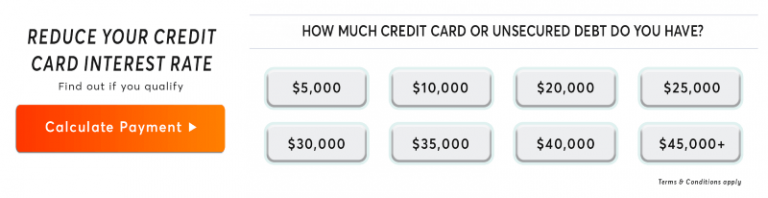

See if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Reduce car Insurance costs

As a result, you may end up paying more for a car due to a bad credit rating. On the other hand, you may enjoy more affordable car insurance with a good credit score.

Pay less for smart phones

Credit ratings are also analyzed even for purchasing certain products such as smartphones. That’s why providers may offer expensive, pay-as-you-go contracts for customers buying the latest models.

In contrast, those with good credit scores may receive discounted prices with no security deposit required.

Facilitate Job Application

Since credit reports measure a person’s trustworthiness, employers also check them when selecting applicants. If you can be relied on to pay diligently, you’re more likely to be dependable for office tasks as well. This is why having a good credit score increases your chances of landing a job.

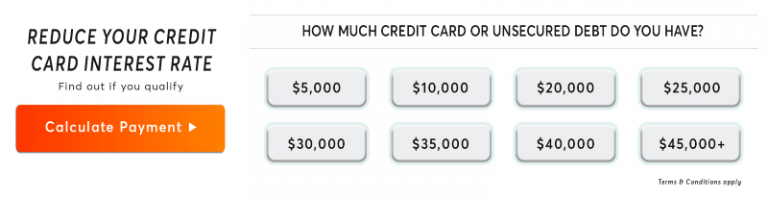

You may check your eligibility in two simple steps!

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 – Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

How to build good credit

If you have a terrible credit report, there’s still hope in improving your credit score. However, you should start by getting your copy before proceeding, if you haven’t done so recently. There are online sources that may charge nothing for your credit report.

Remember that building your credit starts with you, but you may ask others for help to get there.

Pay balances on time

First, the most essential method in building good credit is through paying diligently. It measures how reliable you are in paying debts back. Consequently, building a consistent record of diligent payments will eventually raise your credit score.

Avoid opening more credit accounts as it may deduct from your credit score. Doing so will prompt your issuer to perform a hard credit check, setting your score back even further. Retain existing ones and use them constantly but sparingly in order to stay current.

Reduce credit utilization

This is the comparison between your balances and your credit limit, showing how much debt you’re accruing. Keeping it low means you’re handling your finances well, so it pulls your rating further up.

You may lower utilization by paying back debts, leading to higher credit rating consequently.

Take out credit builder loan

There are even loans called credit builders that help raise your credit rating. It’s carrying a balance that works similarly to most loans, but it returns your money after successfully completing payments. Learn more about credit-builder loans and how they can systematically improve your credit profile.

These count as completed payments on your credit history, adding to your credit score in the process.

See if you qualify in two simple steps

Step 1 – Select your debt amount below to see if you’re eligible

Step 2 –Answer a few quick question & join thousands of American on the path to saving money on interest rate unsecured debt

Use debt reduction strategies

These loans particularly apply to credit card balances across all your credit card accounts. that You may ask your credit card issuer for balance transfer cards for debt consolidation. In response, they may issue one that has a 0% introductory period, so you may repay your principal debt directly.

For severe financial troubles, you may ask for debt settlement from certain companies. They’ll negotiate with your lenders on your behalf, so you can pay a lesser amount back. Research the best debt consolidation loan companies to find reputable lenders who offer competitive terms and transparent practices. Keep in mind that this may hit your credit rating negatively. Alternatively, credit counseling may provide debt management plans to facilitate debt payoff.

In summary, use all methods possible, and don’t hesitate to ask for assistance. There are free online courses that may teach you DIY debt payoff methods such as the debt avalanche and debt snowball. If all else fails, you may always file for bankruptcy. However, beware that doing so will impact your credit report for at least a decade.