Home / Travel Loans

Make Your Dream Vacation a Reality with a Travel Loan

- Finance Flights, Hotels, and Experiences

- Affordable Fixed Rates & Flexible Terms

- No Prepayment Penalties—Pay Off Early and Save

Applying will not impact your credit score

Why Choose LendcoFunding for Your Travel Loan?

Whether you’re planning a dream vacation, a honeymoon, or a long-overdue getaway, a LendcoFunding Travel Loan can help you cover the costs without financial stress.

Fund Your Adventure

Borrow $1,000 to $50,000 for flights, accommodations, cruises, and more.

Predictable Monthly Payments

hoose a 3-year or 5-year term with fixed interest rates from 4.6% to 35.99%.

Fast & Easy Process

Apply in minutes and receive funds in as fast as 1 business day.

No Prepayment Penalties

Pay off your loan early and save on interest—with no extra fees.

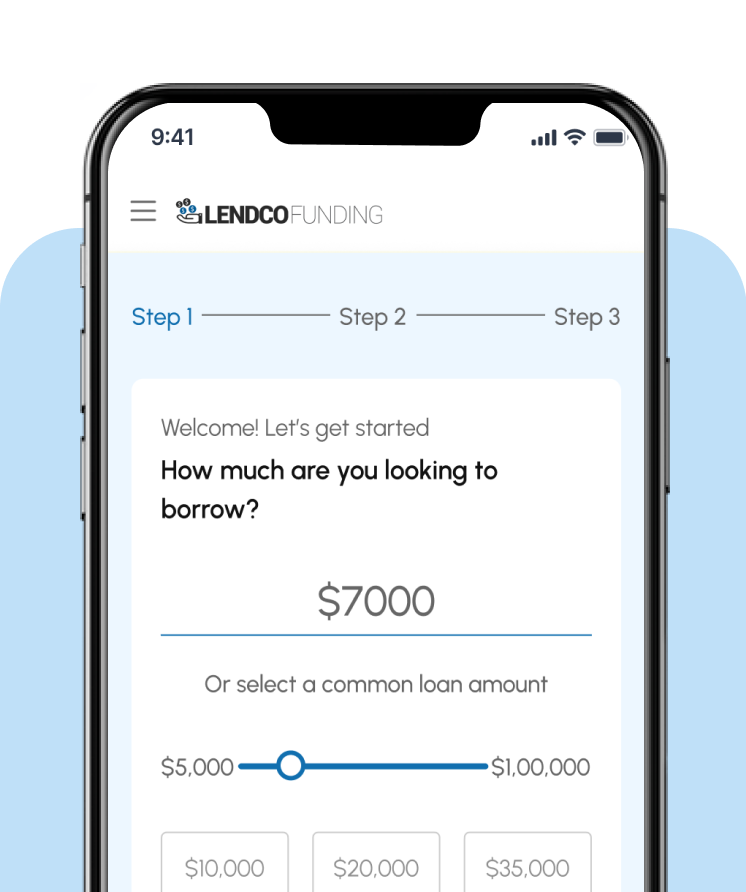

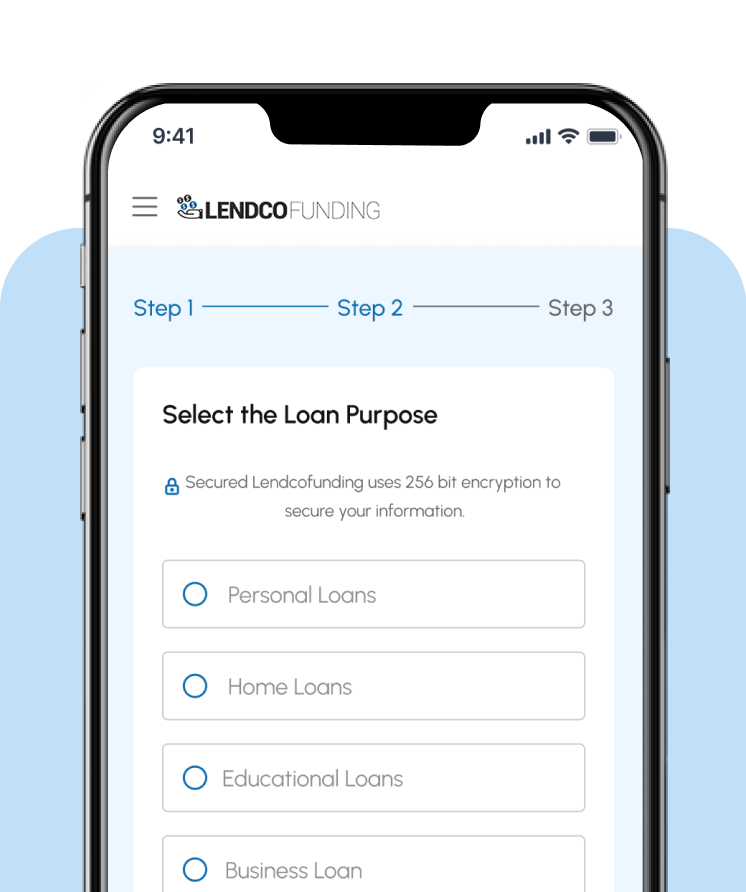

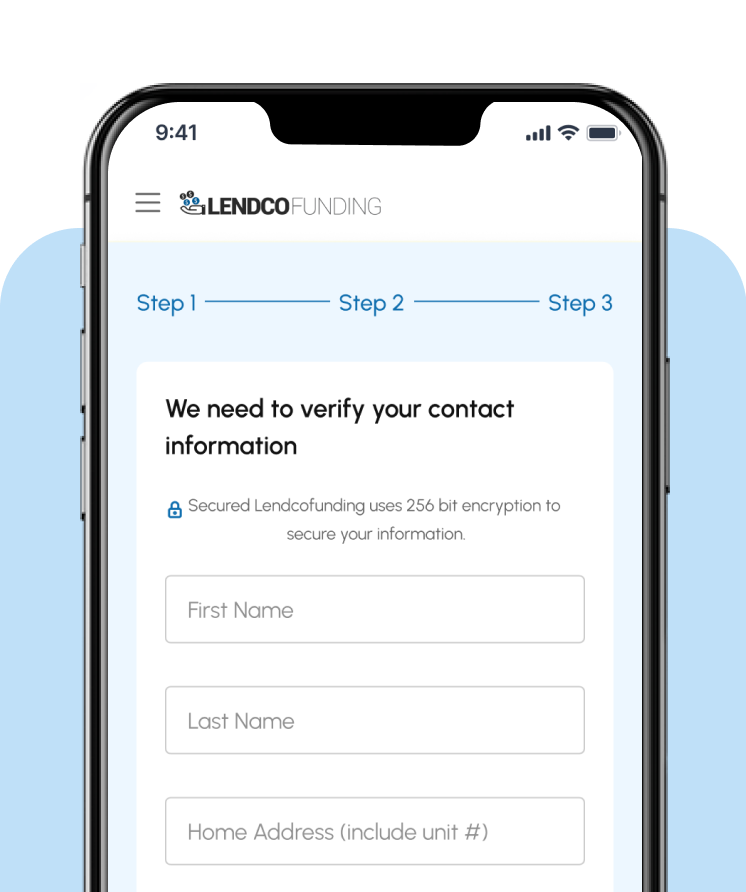

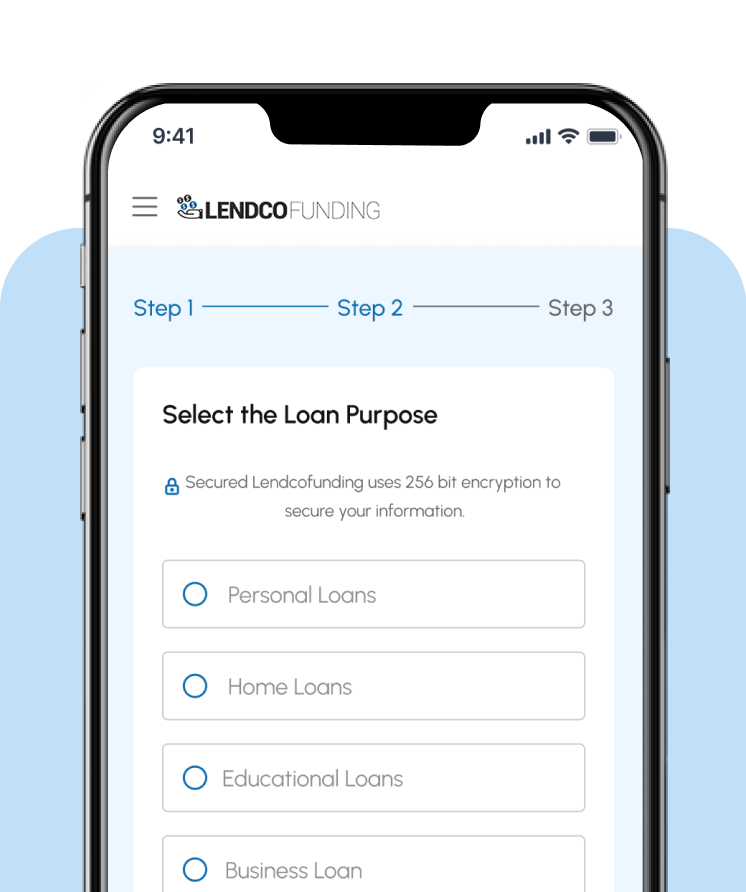

Get Your Auto Loan in 3 Easy Steps

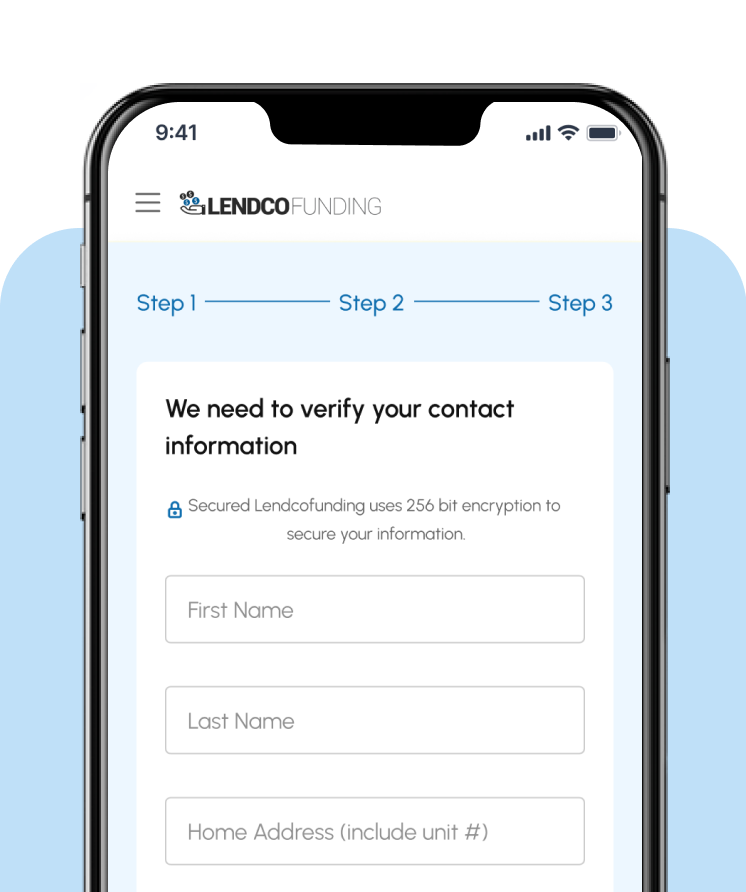

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Applying will not impact your credit score

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Frequently Asked Questions

What can I use a travel loan for?

A travel loan can be used for a wide range of travel expenses, including flights, hotels, vacation rentals, cruises, rental cars, guided tours, and all-inclusive travel packages. It allows you to spread out the cost of your trip into manageable monthly payments.

How does the loan application process work?

Applying is simple and takes just a few minutes. Fill out our online application with basic details about your financial situation. After submitting, you’ll receive an instant decision. If approved, you can review your loan terms, select the best option for you, and receive funds quickly.

How fast can I receive my funds?

Once your loan is approved and finalized, funds can typically be deposited into your account within one to three business days. This allows you to book your trip and secure travel deals without delay.

Can I qualify for a travel loan with bad credit?

Yes! While a strong credit score can help you secure lower rates, we look at multiple factors beyond just your credit score, such as income, employment history, and overall financial health. Even with less-than-perfect credit, you may still qualify for a travel loan.

Are there any fees associated with the loan?

We believe in transparent lending with no hidden fees. Any applicable charges, such as origination fees, will be clearly stated in your loan agreement before you accept your loan offer.

Can I pay off my loan early?

Yes! There are no prepayment penalties, so you can pay off your loan ahead of schedule and save on interest without any extra charges.

Turn Your Dream Trip into Reality with a LendcoFunding

Applying will not impact your credit score