Home / Mortgage Refinance

Refinance Your Mortgage & Save with LendcoFunding

- Lower Your Monthly Payments & Reduce Interest

- Flexible Loan Terms to Fit Your Needs

- Access Your Home Equity for Cash

Applying will not impact your credit score

Why Choose LendcoFunding for Your Mortgage Refinance?

Refinancing your mortgage can help you save money, reduce your interest rate, and free up cash for other financial goals. Whether you’re looking to lower your monthly payments, shorten your loan term, or access your home equity, LendcoFunding makes the process simple and stress-free.

Lower your Interest Rates

Reduce your mortgage payments with a lower, fixed interest rate.

Flexible Loan Terms

Choose from a variety of repayment options to fit your financial goals.

Cash-Out Refinancing

Access the equity in your home to pay off debts, fund home improvements, or cover other expenses.

No Prepayment Penalties

Pay off your mortgage early and save on interest—with no extra fees.

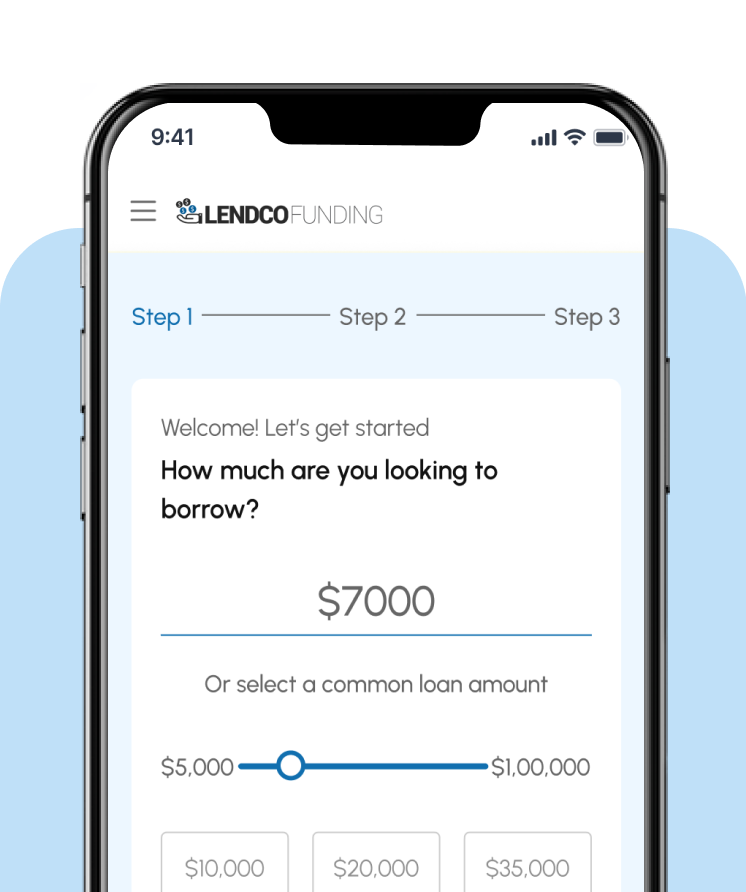

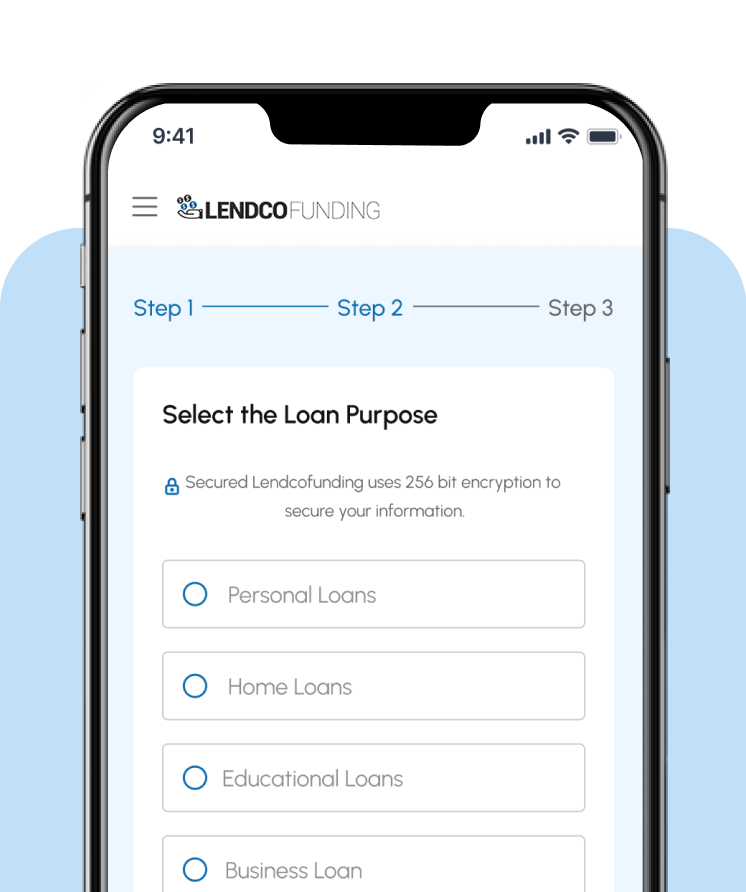

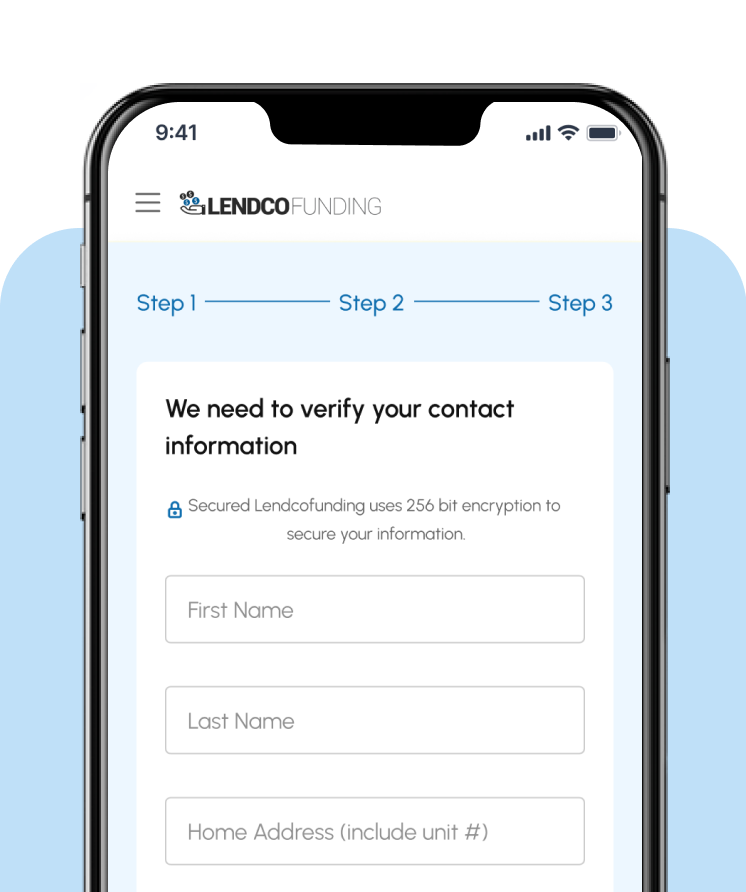

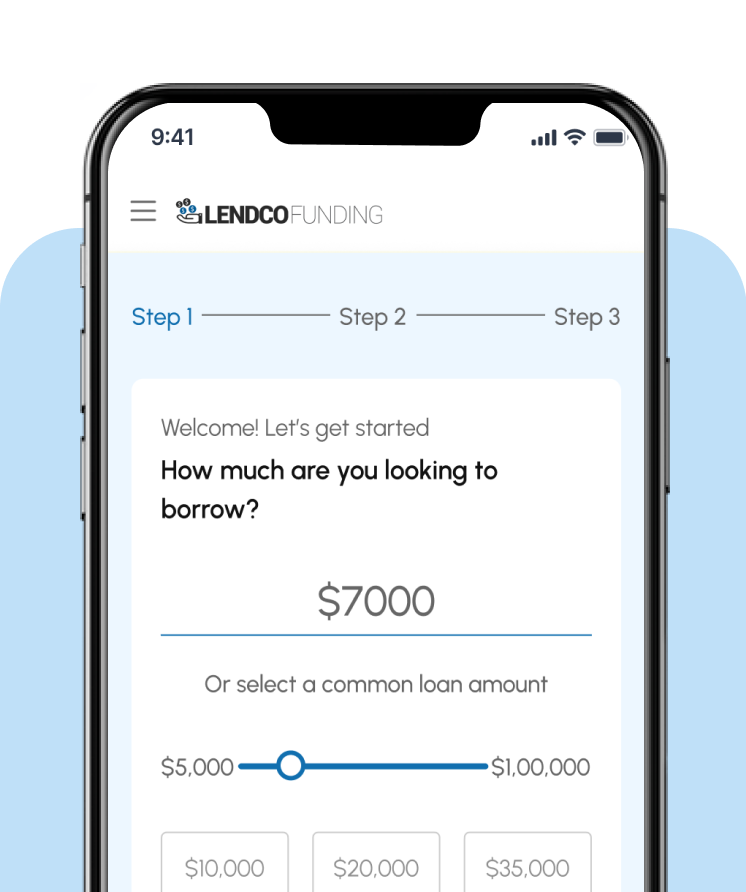

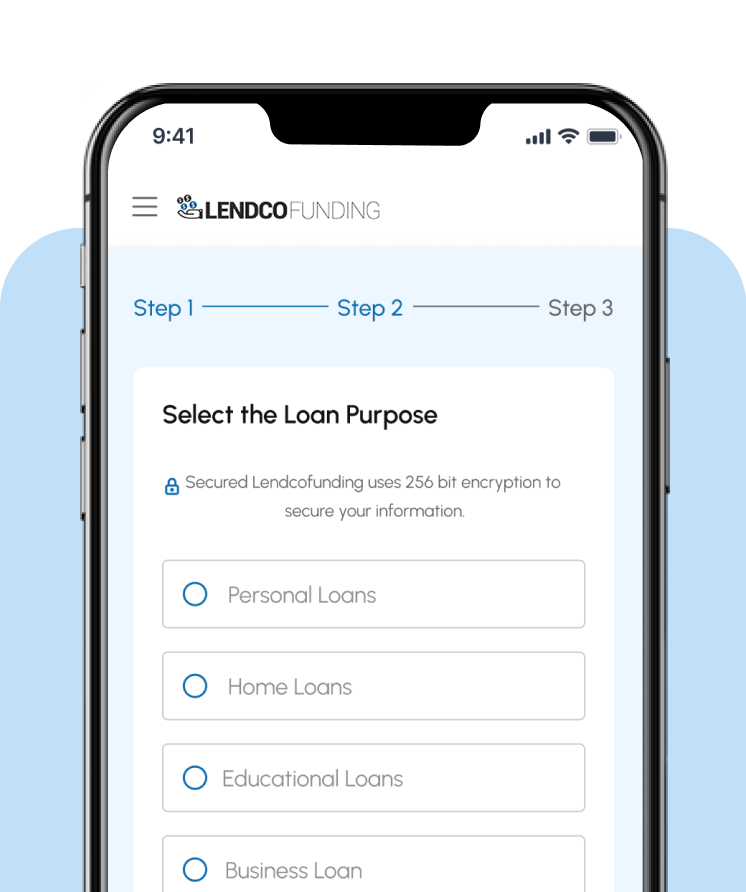

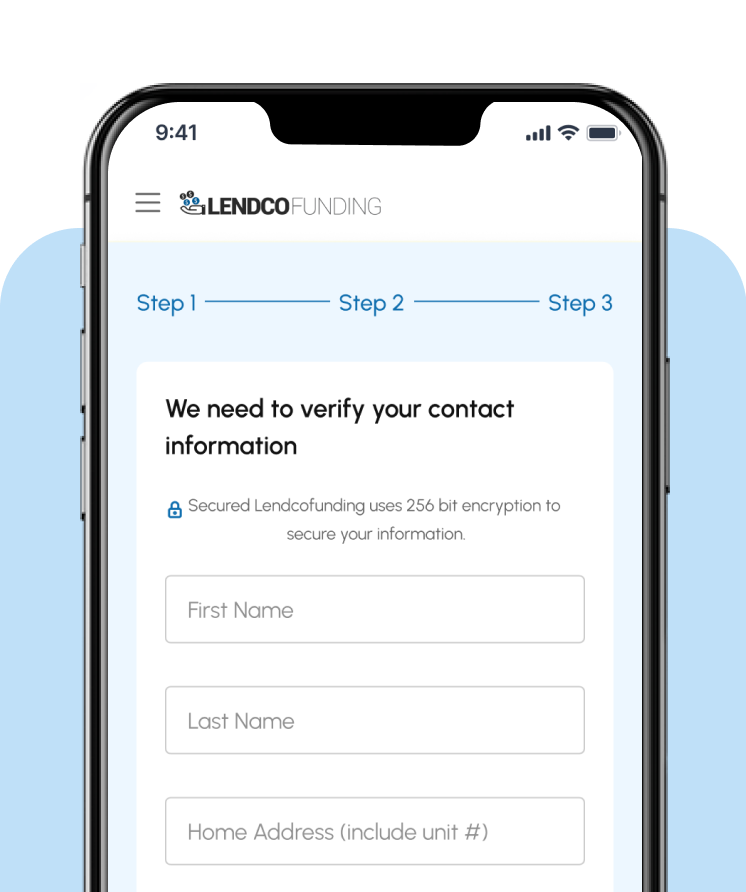

Get Your Auto Loan in 3 Easy Steps

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Applying will not impact your credit score

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Frequently Asked Questions

What is mortgage refinancing?

Mortgage refinancing allows you to replace your current home loan with a new one at better terms, such as a lower interest rate, different loan length, or cash-out option.

How can refinancing save me money?

By securing a lower interest rate or a shorter loan term, refinancing can reduce your monthly payments and total interest costs over time.

How long does the refinancing process take?

The refinancing process can take anywhere from a few days to a few weeks, depending on your loan type and financial situation.

Can I refinance with bad credit?

Are there any fees for refinancing?

We believe in transparent lending—any applicable costs, such as origination fees, will be clearly outlined in your loan agreement before you proceed.

Can I take cash out with my refinance?

Yes! With a cash-out refinance, you can borrow against your home’s equity and use the funds for home improvements, debt consolidation, or other financial needs.

Take the Next Step in Your Homeownership Journey

Applying will not impact your credit score