Home / Educational Loans

Invest in Your Future with an Educational Loan

- Cover Tuition, Books, and Living Expenses

- Affordable Fixed Rates & Flexible Terms

- No Prepayment Penalties—Pay Off Early and Save

Applying will not impact your credit score

Why Choose LendcoFunding for Your Educational Loan?

Education is an investment in your future, and a LendcoFunding Educational Loan can help you achieve your academic and career goals without financial stress. Whether you’re paying for college, trade school, or professional courses, we provide flexible financing to meet your needs.

Fund Your Education

Borrow $1,000 to $50,000 to cover tuition, textbooks, supplies, and living expenses.

Predictable Monthly Payments

Choose a 3-year or 5-year term with fixed interest rates from 4.6% to 35.99%.

Fast & Easy Process

Apply in minutes and receive funds in as fast as 1 business day.

No Prepayment Penalties

Pay off your loan early and save on interest—with no extra fees.

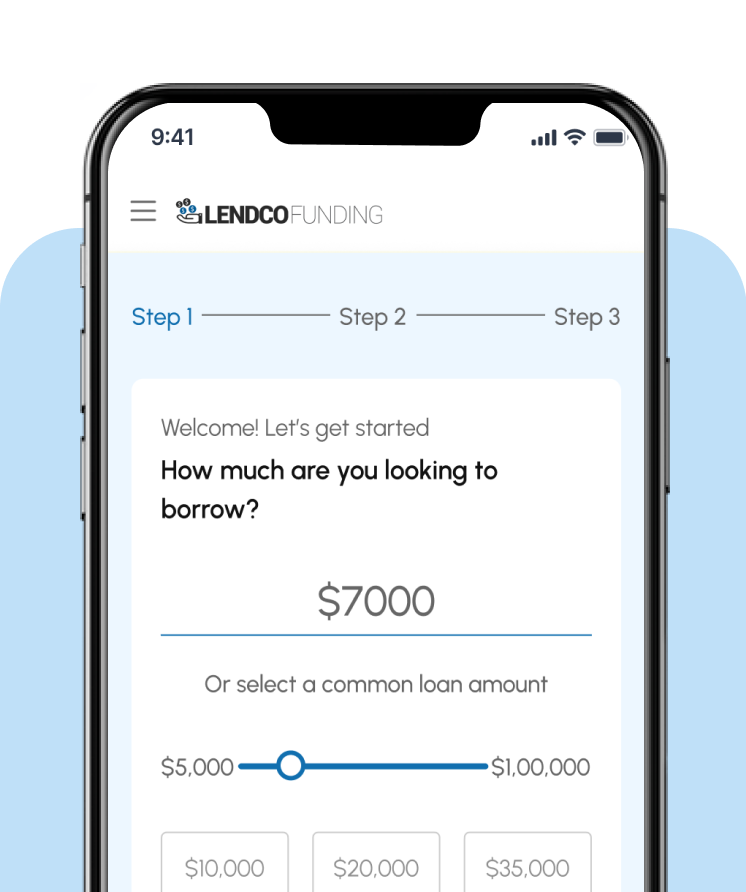

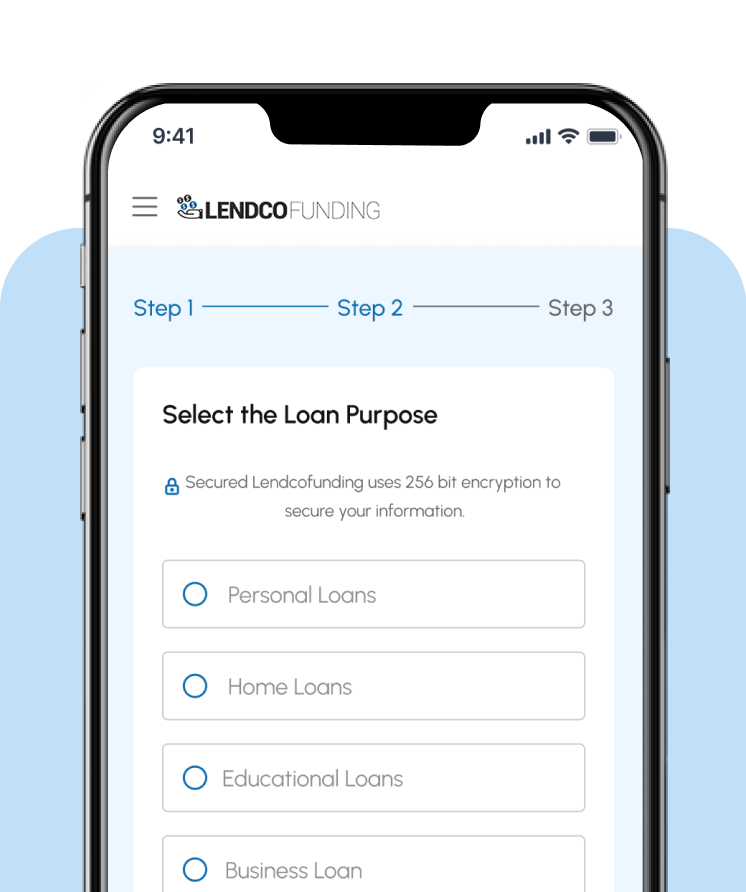

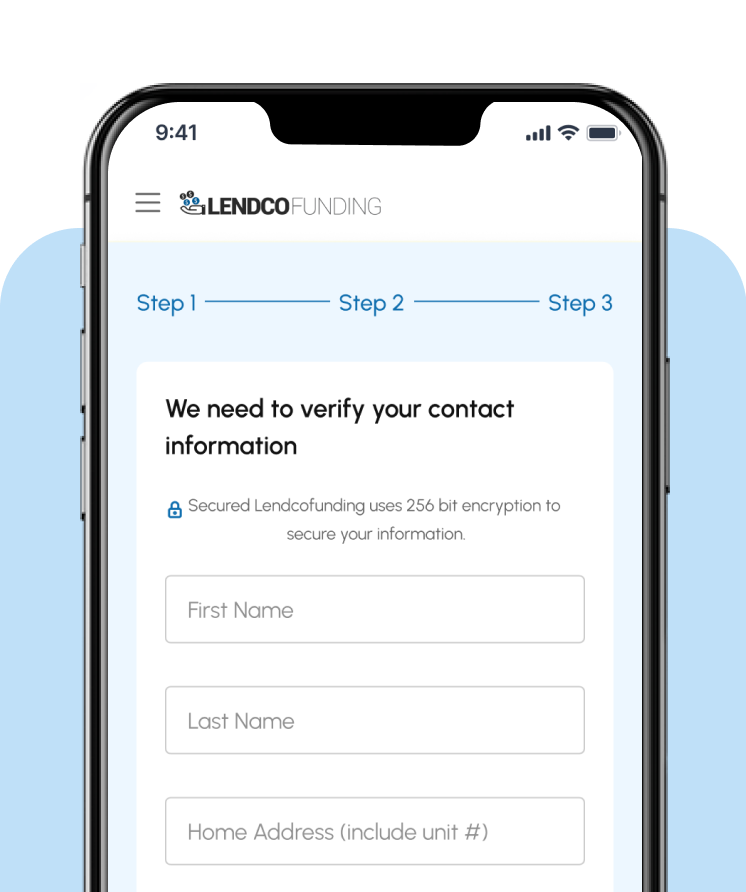

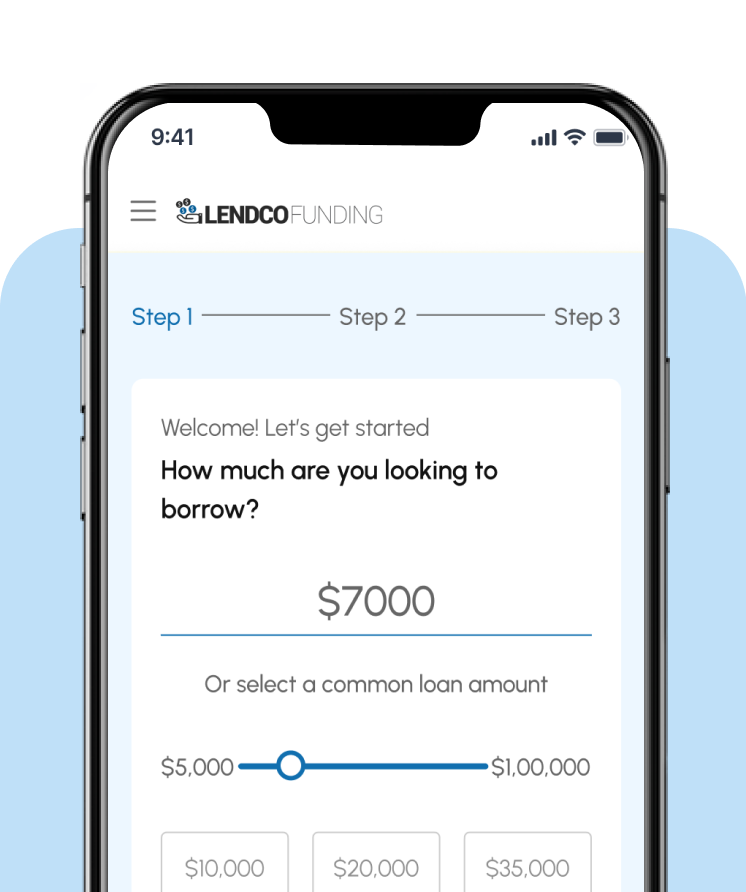

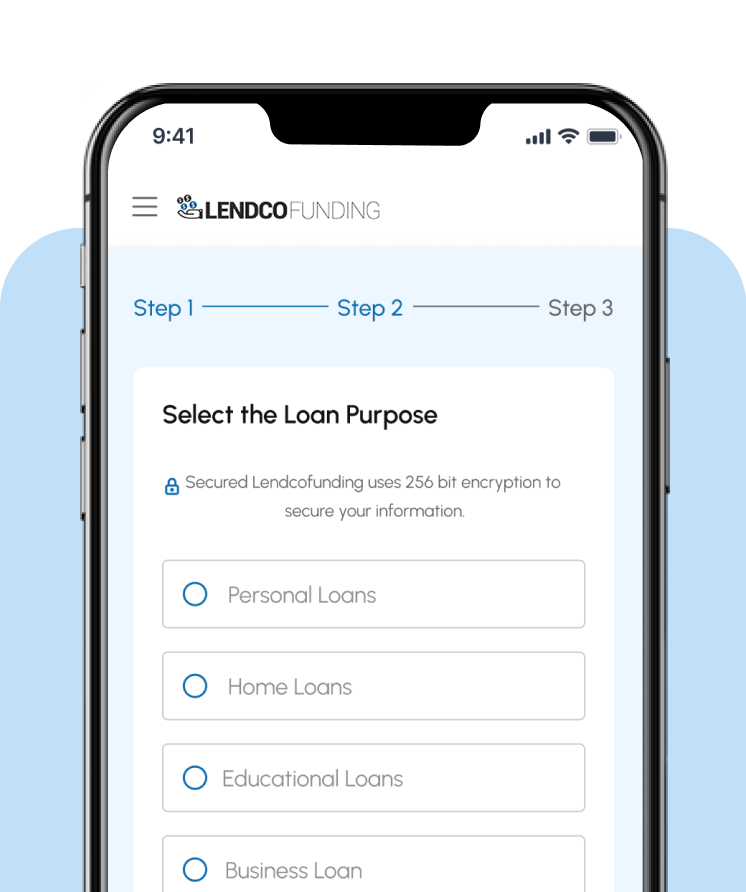

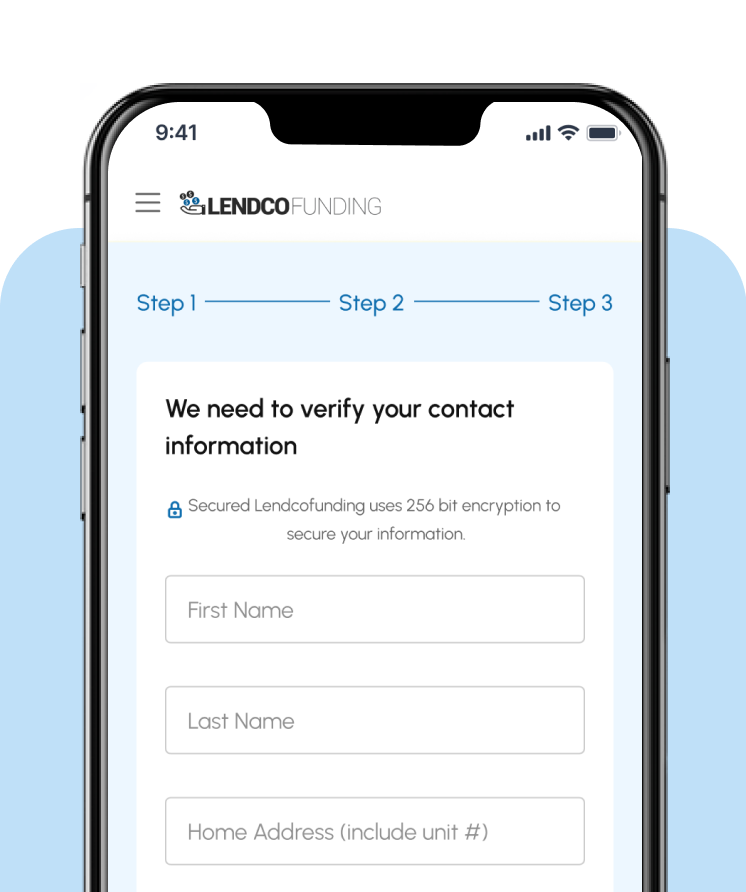

Get Your Auto Loan in 3 Easy Steps

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Applying will not impact your credit score

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Frequently Asked Questions

What can I use an educational loan for?

An educational loan can be used for tuition, textbooks, school supplies, housing, transportation, and other education-related expenses.

How does the loan application process work?

Applying is simple and takes just a few minutes. Fill out our online application, check your personalized rate, and receive an instant decision. If approved, review your loan terms and receive funds quickly.

How fast can I receive my funds?

Once approved, funds are typically deposited in your account within 1-3 business days, so you can cover your education costs without delay.

Can I qualify for an educational loan with bad credit?

Yes! While a strong credit score can help secure lower rates, we evaluate multiple factors beyond just your credit score, including income, employment, and financial history.

Are there any fees associated with the loan?

We believe in transparent lending—no hidden fees. Any applicable costs, such as origination fees, will be clearly stated in your loan agreement.

Can I pay off my loan early?

Absolutely! There are no prepayment penalties, so you can pay off your loan ahead of schedule and save on interest.

Take the Next Step in Your Education with LendcoFunding

Applying will not impact your credit score