Home / Home Improvement Loans

Upgrade Your Home with a Home Improvement Loan

- Finance Renovations, Repairs, and Upgrades

- Affordable Fixed Rates & Flexible Terms

- No Prepayment Penalties—Pay Off Early and Save

Applying will not impact your credit score

Why Choose LendcoFunding for Your Home Improvement Loan?

Turn your house into your dream home with affordable financing tailored to your needs. Whether you’re remodeling your kitchen, updating your bathroom, or making essential repairs, LendcoFunding makes it simple and stress-free.

Finance Your Home Upgrades

Borrow anywhere from $1,000 to $50,000 for remodeling, repairs, or additions.

Predictable Monthly Payments

Choose a 3-year or 5-year term with fixed interest rates from 4.6% to 35.99%.

Fast & Easy Process

Get approved quickly and receive funds in as fast as 1 business day.

No Prepayment Penalties

Pay off your loan early and save on interest—with no extra fees.

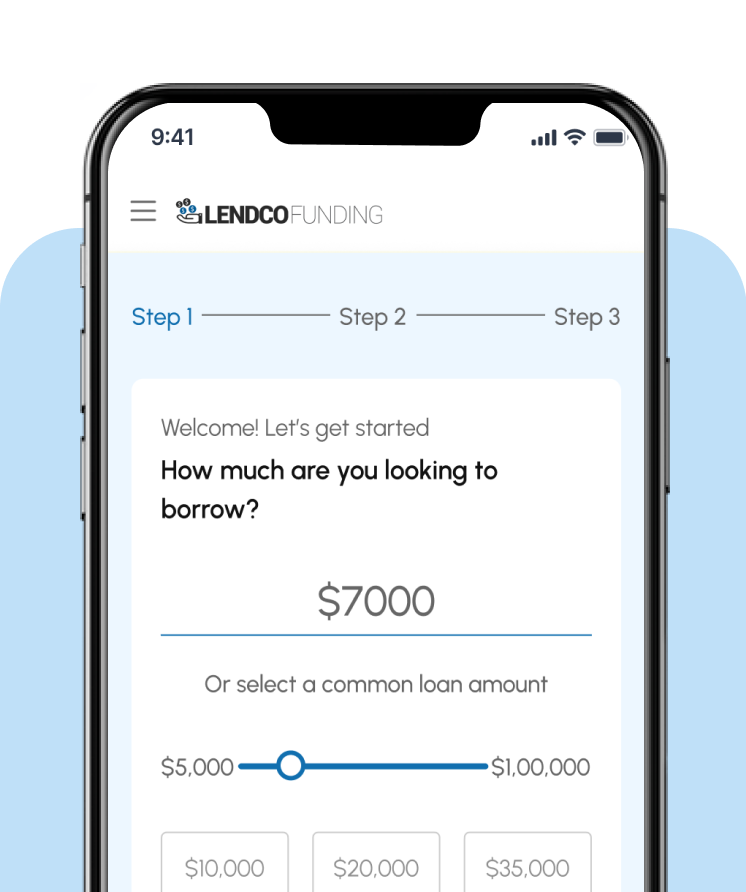

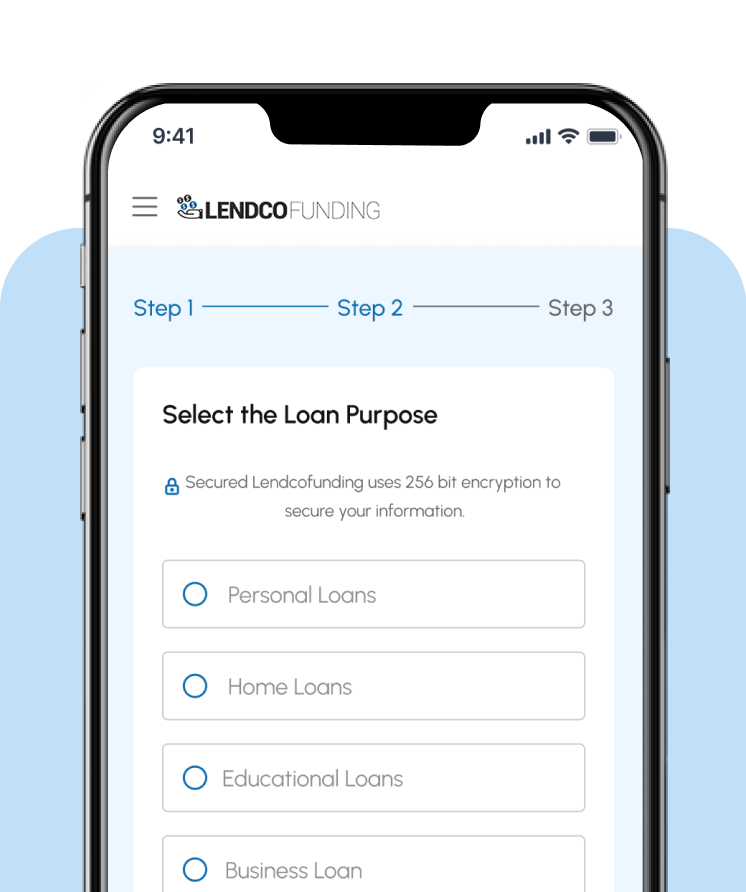

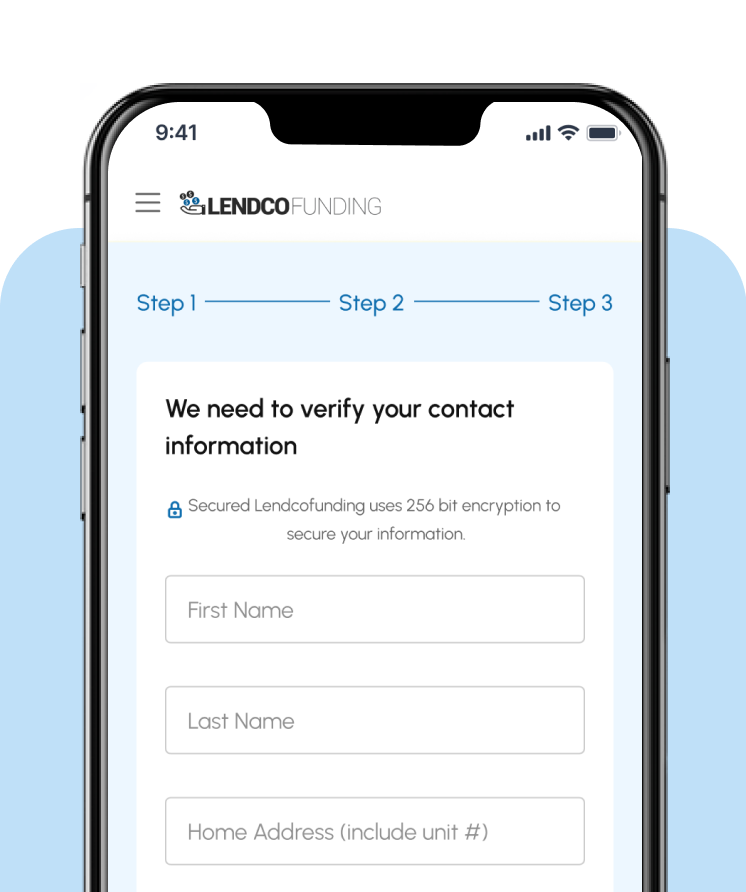

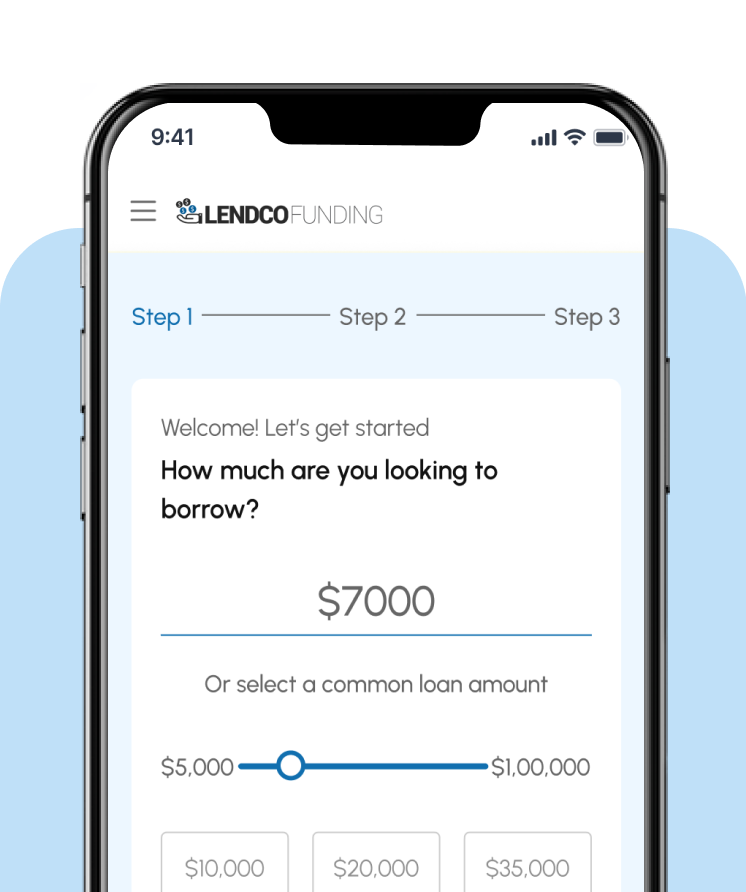

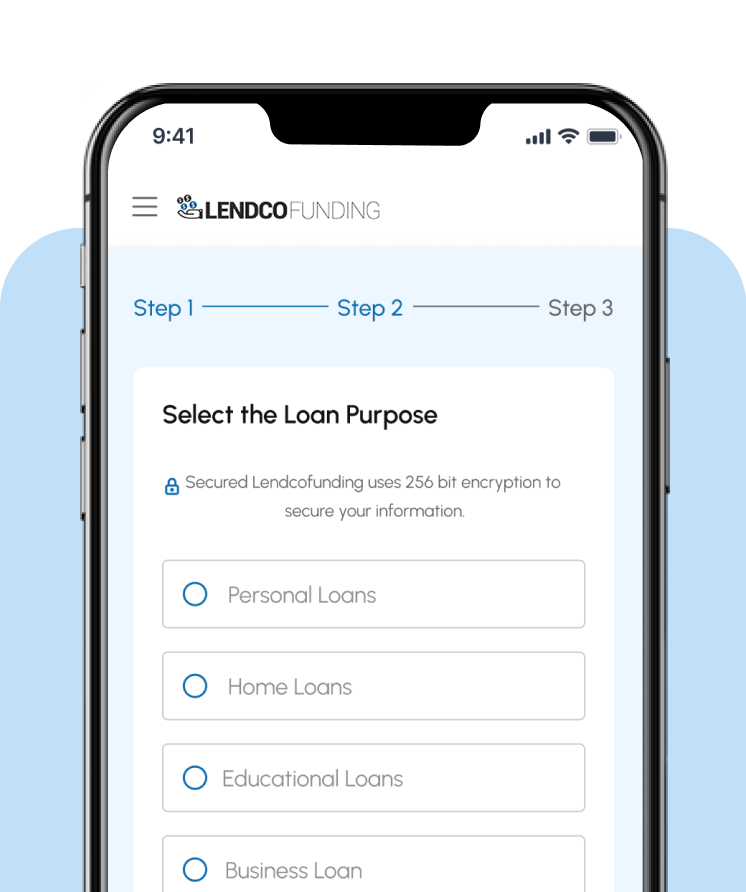

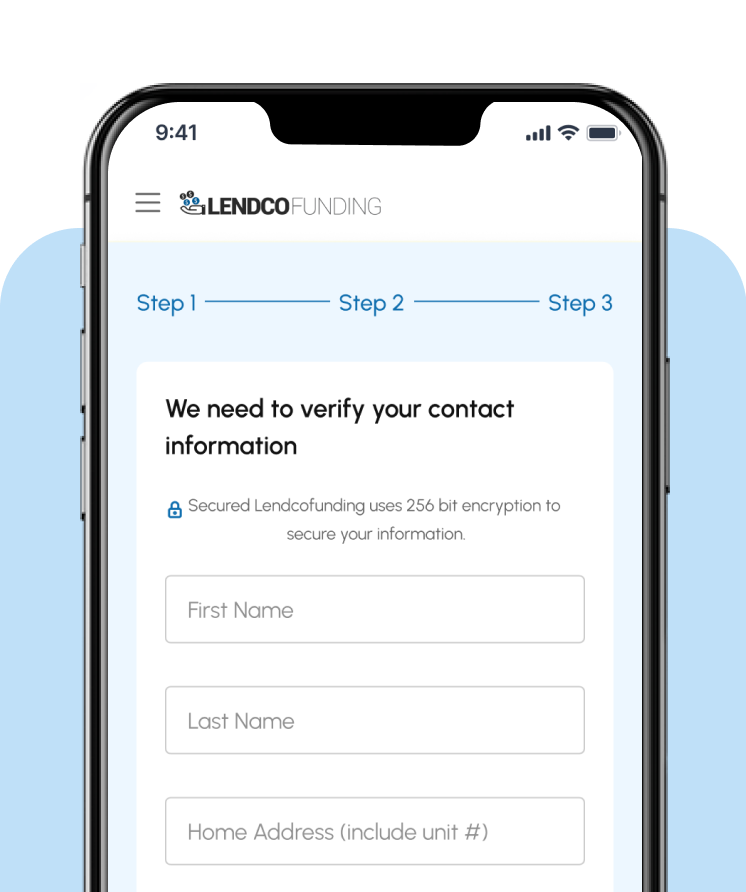

Get Your Auto Loan in 3 Easy Steps

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Applying will not impact your credit score

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Frequently Asked Questions

What can I use a home improvement loan for?

A home improvement loan can be used for remodeling, renovations, repairs, landscaping, new appliances, energy-efficient upgrades, and more. It’s a flexible way to finance projects that enhance your home’s value and comfort.

How does the loan application process work?

Applying is simple! Fill out our quick online form, check your personalized rate, and receive an instant decision. If approved, choose your loan terms and get funded fast.

How soon will I receive my funds?

Once approved, funds can be deposited into your account in as fast as 1 business day, depending on your bank’s processing times.

Can I get a home improvement loan with bad credit?

Yes! While a higher credit score may help secure better rates, we evaluate multiple factors beyond just your credit score, including income, employment, and financial history.

Do I need home equity to qualify?

No, our home improvement loans are unsecured, meaning you don’t need to use your home as collateral. You can finance your renovations without tapping into your home equity.

Are there any fees associated with the loan?

We believe in transparent lending—no hidden fees. Any applicable costs, such as origination fees, will be clearly stated in your loan agreement.

Transform Your Home with a LendcoFunding Home Improvement Loan

Applying will not impact your credit score

Other loan options

Debt Consolidation Loans

Invest in your education with our supportive student loans, designed for your academic journey.