Home / Business Loans

Power Your Business Growth with Flexible Funding

- Finance Expansion, Equipment, or Working Capital

- Affordable Fixed Rates & Flexible Terms

- No Prepayment Penalties—Pay Off Early and Save

Applying will not impact your credit score

Why Choose LendcoFunding for Your Business Loan?

Securing the right business loan can help you grow your company, manage cash flow, and invest in new opportunities. Whether you’re looking for working capital, equipment financing, or expansion funds, LendcoFunding makes the process fast, simple, and stress-free.

Lower Interest Rates

Get competitive rates to keep your business expenses manageable.

Flexible Loan Terms

Choose a repayment plan that aligns with your cash flow and financial goals.

Fast Funding

Access funds quickly—sometimes in as fast as one business day.

No Prepayment Penalties

Pay off your loan early and save on interest—with no extra fees.

Diverse Loan Options

From working capital to lines of credit, find a loan that fits your unique business needs.

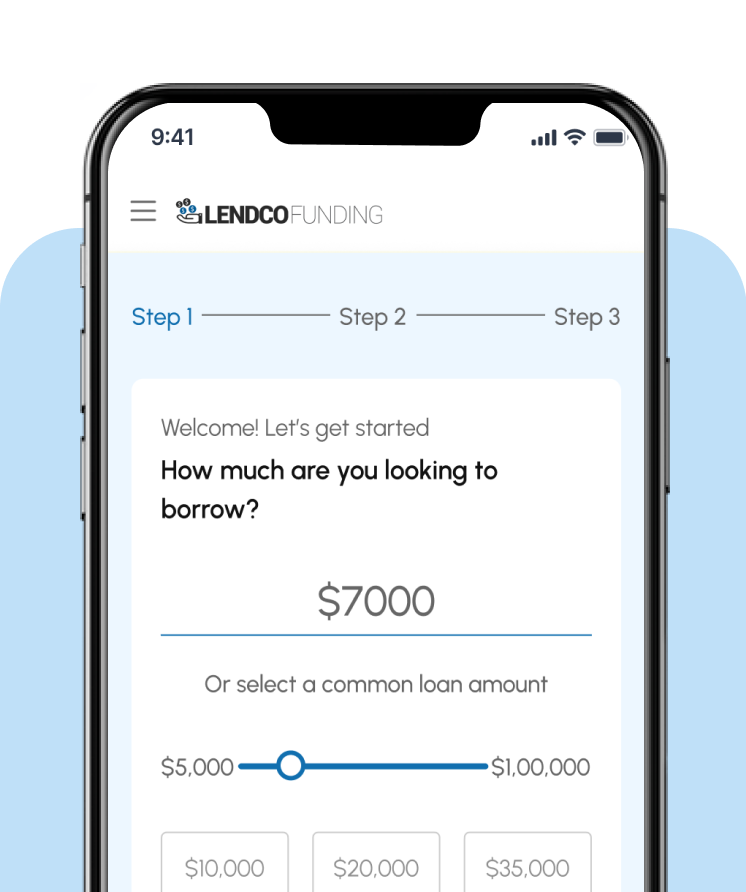

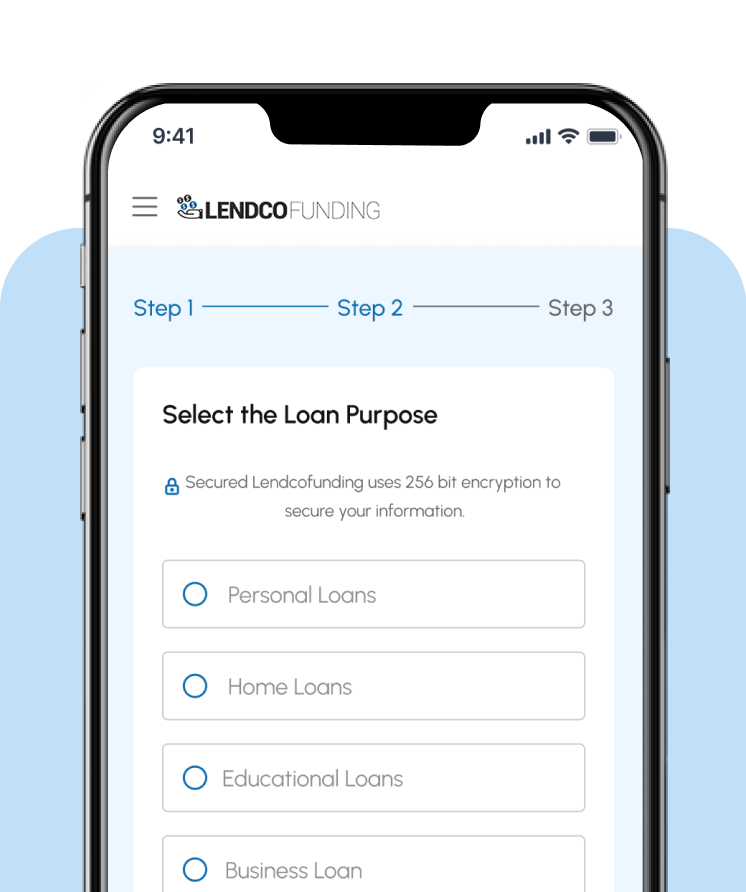

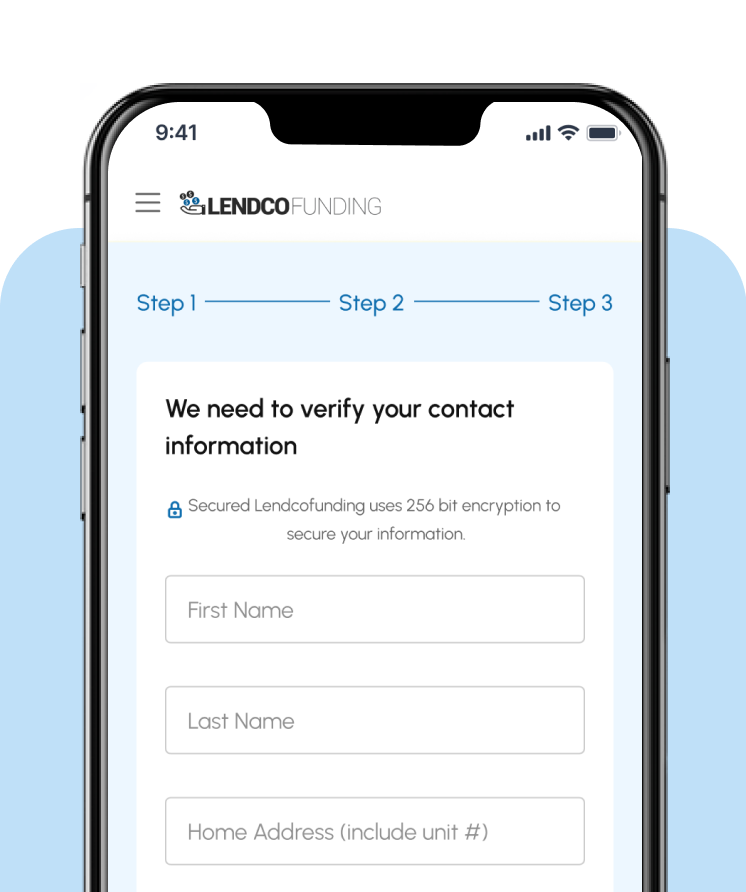

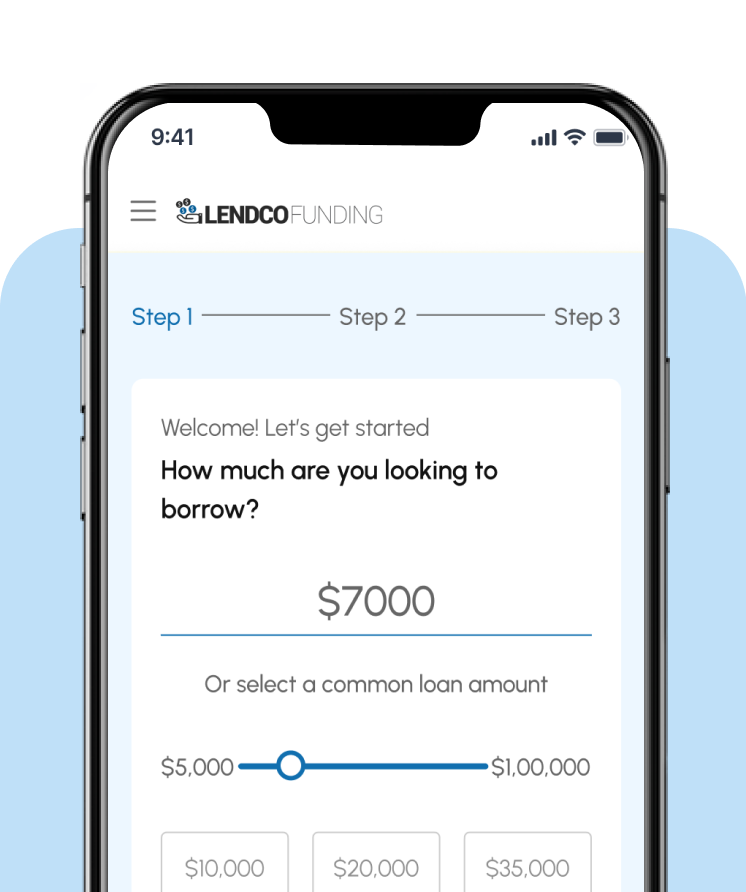

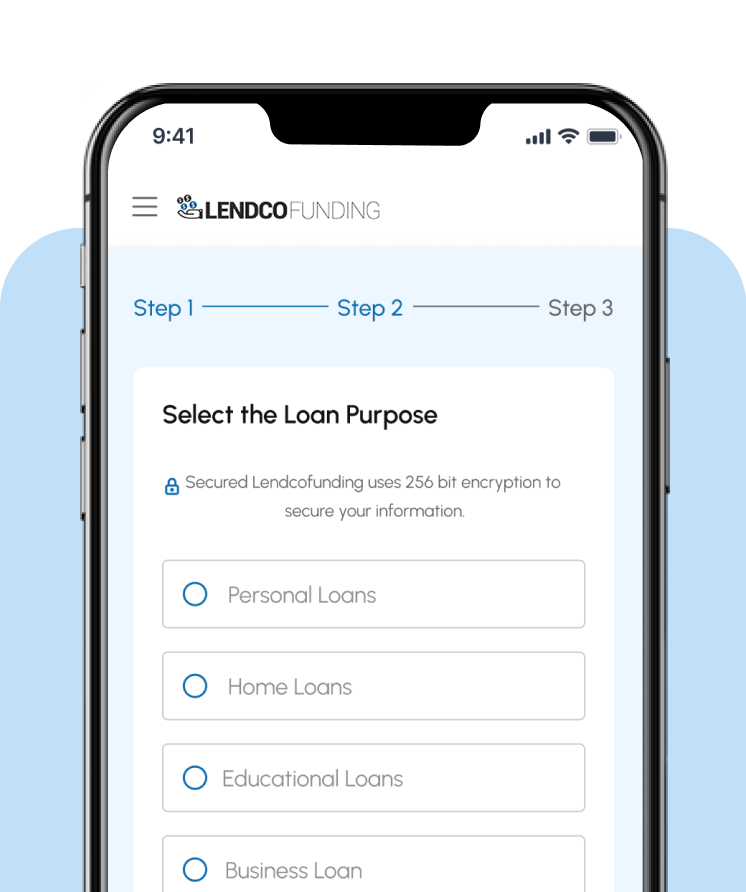

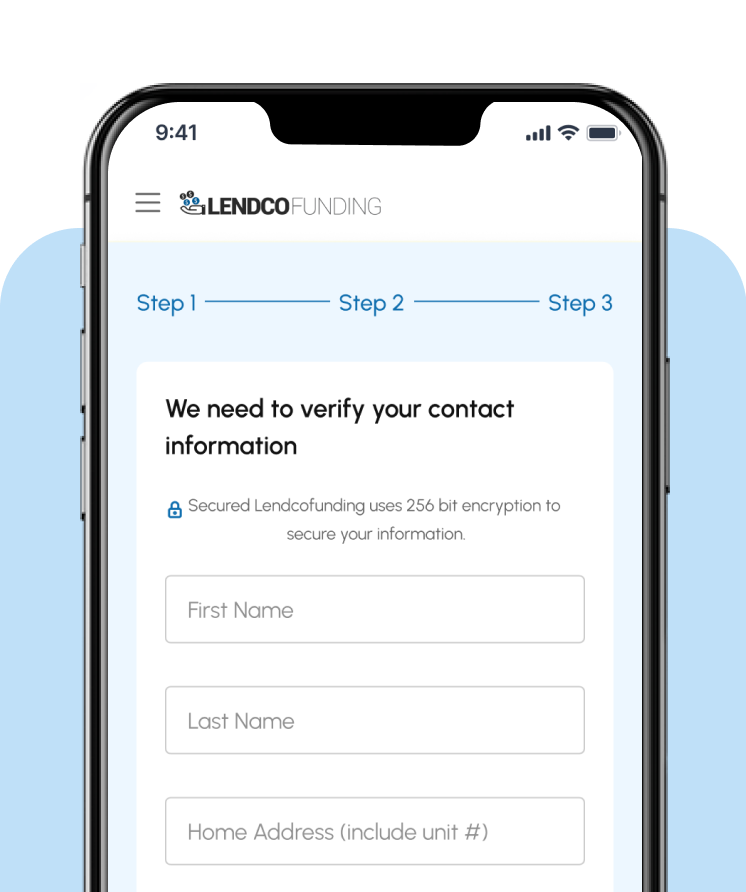

Get Your Auto Loan in 3 Easy Steps

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Applying will not impact your credit score

Submit Your Information

Get Approved

Receive Your Funds

Once approved, funds can be deposited into your account in as fast as 1 business day.

Frequently Asked Questions

What types of business loans are available?

How much can I borrow?

Loan amounts depend on business revenue, financial history, and creditworthiness. Businesses may qualify for loans ranging from $10,000 to several million dollars.

Do I need collateral to secure a loan?

It depends on the loan type. Some loans require collateral (such as equipment or real estate), while others, like unsecured loans, do not.

What factors impact my loan eligibility?

Lenders consider credit score, revenue, cash flow, time in business, and financial stability when determining loan approval and terms.

How fast can I receive my funds?

Depending on the loan type, funds can be deposited within 24 hours of approval. Larger loans, such as SBA loans, may take a few weeks to process.

Are there any fees associated with business loans?

Grow Your Business with the Right Funding

Applying will not impact your credit score